The dollar milkshake theory pt. III

We end our three part series by exploring cryptocurrency’s role in the sovereign debt crisis

Review

In part I and II of our series, we explored the qualities of our global economic system that make it susceptible to the dollar milkshake theory. The deep reliance on the U.S. dollar, growing global debt, excessive fiat printing by central banks, and a looming recession have primed global economies for a sovereign debt crisis. In brief, the dollar milkshake theory describes how a sovereign debt crisis could result in the fall of all global fiat currencies relative to the U.S. dollar. Initially, the U.S. dollar will rise and eventually also collapse along with other global fiat currencies. In part III, we will outline the role cryptocurrency could play in this theory.

Precursor to the dollar milkshake theory

The current state of our global economy could be a precursor for the dollar milkshake theory. The U.S. dollar hit a one month high on February 6 while other currencies like the yen, the franc and the pound fell. On February 7, 2023, Federal Reserve Chair Jerome Powell announced that the U.S. had hit its statutory debt limit last month – the total amount of money that the U.S. can borrow to meet its existing legal obligations like medicare benefits, interest on national debt, tax refunds and other payments. Lawmakers have avoided raising the debt limit to push for spending cuts, but failure to raise the debt limit could be catastrophic. The U.S. could default on its debt for the first time in history.

Precursor to the dollar milkshake theory by nplus1data on TradingView.com

Confidence Crisis

When governments cannot gain control over a country’s inflation or debt, people’s confidence begins to wane. When a confidence crisis occurs, investors are bullish on gold and silver as an inflation hedge. Gold and silver are inherently valuable due to their scarcity and use value. The precious metal sector is expected to do well this year as geopolitical tension, inflation worries and monetary policy could boost prices to record highs in many currencies, including the U.S. dollar. According to the World Economic Forum last year central banks driven by inflation accumulated gold reserves in amounts not seen since 1967.

Cryptocurrency as an alternative safe haven

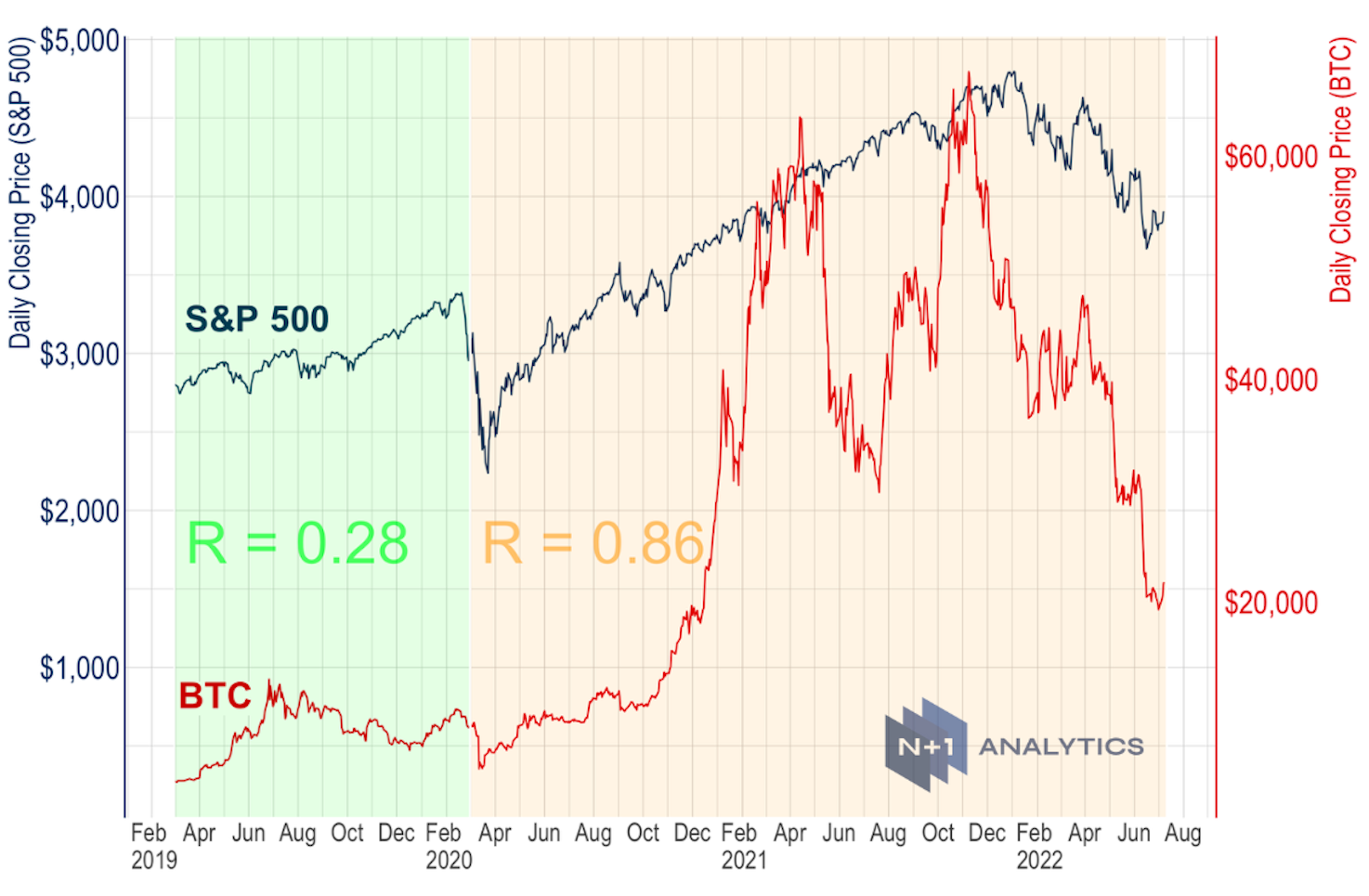

While central banks and investors clamour for gold, others look toward alternative safe havens, like cryptocurrency. There are mixed opinions on the effectiveness of bitcoin as a safe haven. Some academics argue that bitcoin contains a considerable speculative element that makes it prone to collapse. Price volatility, state restrictions on mining, and a positive correlation to equity markets strengthen the view that bitcoin should be viewed as a speculative asset rather than a safe haven or transaction medium. However, some investors believe that the recent crypto sell off is indicative of a general risk aversion and does not invalidate bitcoin’s safe-haven status.

If the dollar milkshake theory comes true and fiat currencies collapse, including the U.S. dollar, cryptocurrencies will surge. El Salvador is evidence that a government’s inability to control monetary policy can lead to mass adoption of cryptocurrency. Increased adoption of bitcoin could also lead to a boost in stablecoins, which are increasingly backed by U.S. government debt or Treasury bills. Currently, stablecoins make up 2% of the market for Treasury bills. In this case, increased stablecoin adoption would boost the U.S. dollar too.

When trust is down, crypto is up

Satoshi Nakamoto created bitcoin when distrust in centralized institutions was at a peak – following the 2008 mortgage crisis and subsequent bank bailouts. Bitcoin was designed as a tool for citizens to maintain digital sovereignty and exchange currency without the need for third party intermediaries. The conclusion to the dollar milkshake theory would see an absolute repudiation of the efficacy of centralized institutions to keep our economic system in check, likely shining a light on alternative currency systems, like crypto. When trust in institutions is down, crypto goes up.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.