The dollar milkshake theory pt. II

In part I of our dollar milkshake series, we began with a brief history of fiat currency and outlined the role of the U.S. dollar in global economics systems. In part II, we delve deeper into the theory and apply it to today’s economic environment.

The U.S. dollar versus a basket of global currencies (e.g., DXY - U.S. Dollar Currency Index) has fallen approximately 8.8% since its high of 114 in September to about 104 as of January. This means that a basket of major global currencies have rallied. Experts continue making the case for an upcoming, global recession, predicting the “worst for the world economy in four decades.” Historically this has preceded an increased flight to safety or demand for the dollar. While the dollar has weakened since late last year, the dollar milkshake theory suggests a continued increase in the dollar relative to other global fiat currencies.

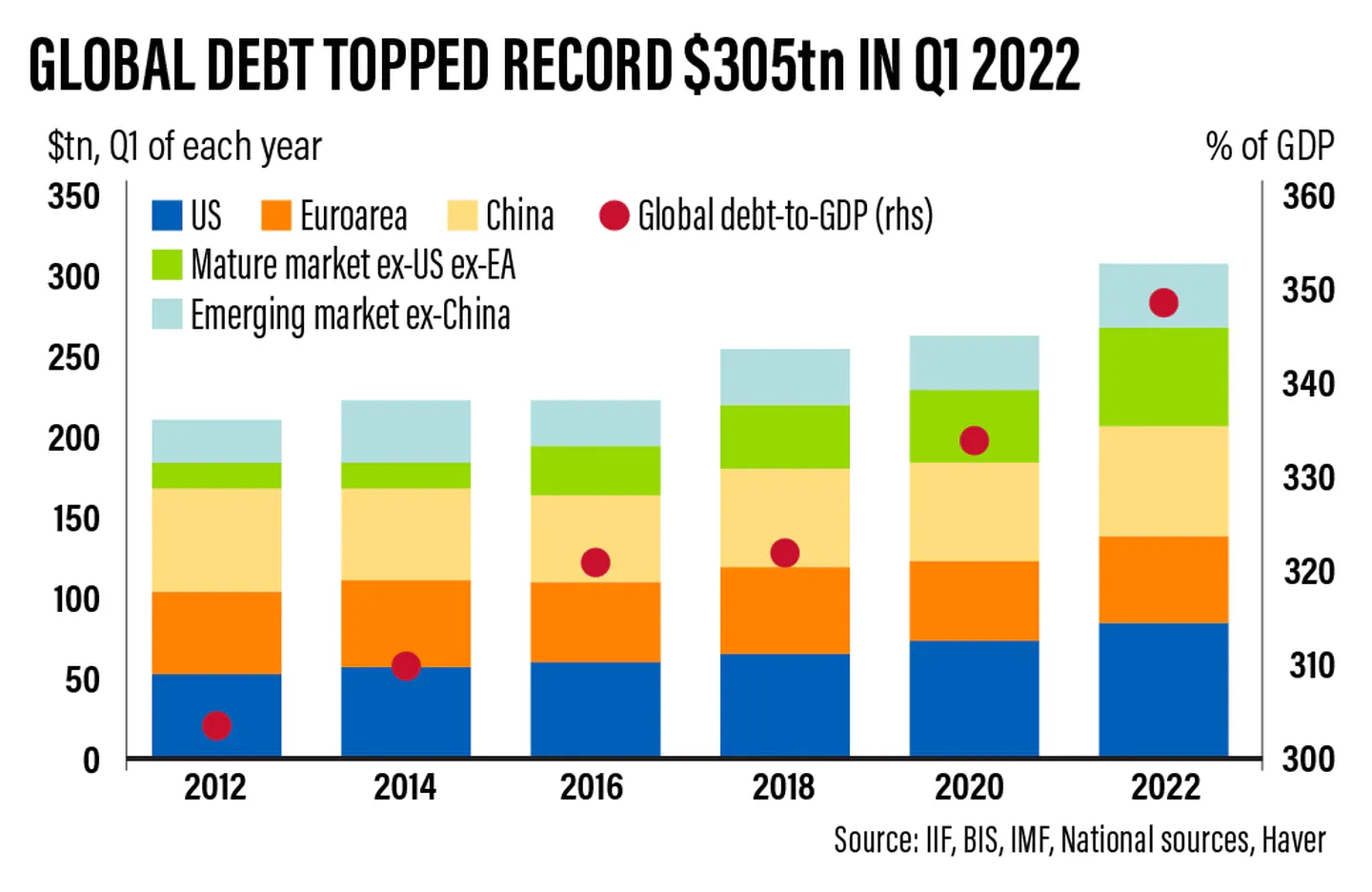

To review, the dollar milkshake theory proposes a coming sovereign debt and currency crisis. The theory, introduced by Brent Johnson, CEO of Santiago Capital, posits that global central banks have debased the global fiat currencies by overprinting and sovereign governments have increased debt to unsustainable levels relative to their country’s GDP. Thus while the inherent value of all global fiat currencies are declining, the U.S. dollar remains the strongest of all the global fiat currencies. According to Johnson, the U.S. dollar is the straw, sucking up the milkshake of global liquidity.

As the sovereign debt crisis matures, global financial asset demand is driven to the United States economic system. Specifically, the sovereign debt crisis results in the fall of all global fiat currencies relative to the U.S. dollar because the U.S. dollar is the reserve currency, is used for most of the world’s transactions, and represents the world’s strongest economy and financial assets. Initially, the U.S. dollar experiences an initial rise in relation to all other currencies. Eventually, the U.S. dollar itself will collapse, too, but not before the collapse of the other global fiat currencies.

The preconditions for the dollar milkshake theory have already become reality. Since 2008 and especially during COVID-19, central banks have printed an exorbitant amount of money. While debt ratios fell in 2021 following the record surge in 2020, global debt still remains higher than pre-pandemic levels. The year 2022 was marked by inflation as the cost of living, gas and groceries spiked the world over. Central banks worked to decrease this inflation by raising interest rates – in the U.S., interest rates were increased 7 times in 2022.

![![debt-ratios]](https://www.nplus1insights.com/content/images/2023/01/debt-ratios.png)

Most central banks opted to print money in response to a looming recession. However, the value of each country’s currency is a function of several factors, such as national debt, central bank printing, as well as the demand for that country’s goods, services, and financial assets. As the global reserve currency as well as one of the most powerful economies, the U.S. dollar has remained exceptionally strong despite global inflation and thus provides supporting evidence for the dollar milkshake theory. International trade, currency reserves and dollar denominated debt ensures the demand for the dollar remains high. Countries, like China, are attempting to slowly reduce their reliance on the U.S. dollar, but it remains the backbone of the global financial system. As economies of the world slow down, the U.S. dollar is sucking up the world's liquidity, causing the U.S. dollar to rise even further while the global currencies and economies of the world suffer. Eventually, as the dollar rises, other countries scramble for U.S. dollars forcing the devaluation of their own currencies.

![[dollar-surge-1]](https://www.nplus1insights.com/content/images/2023/01/dollar-surge-1.png)

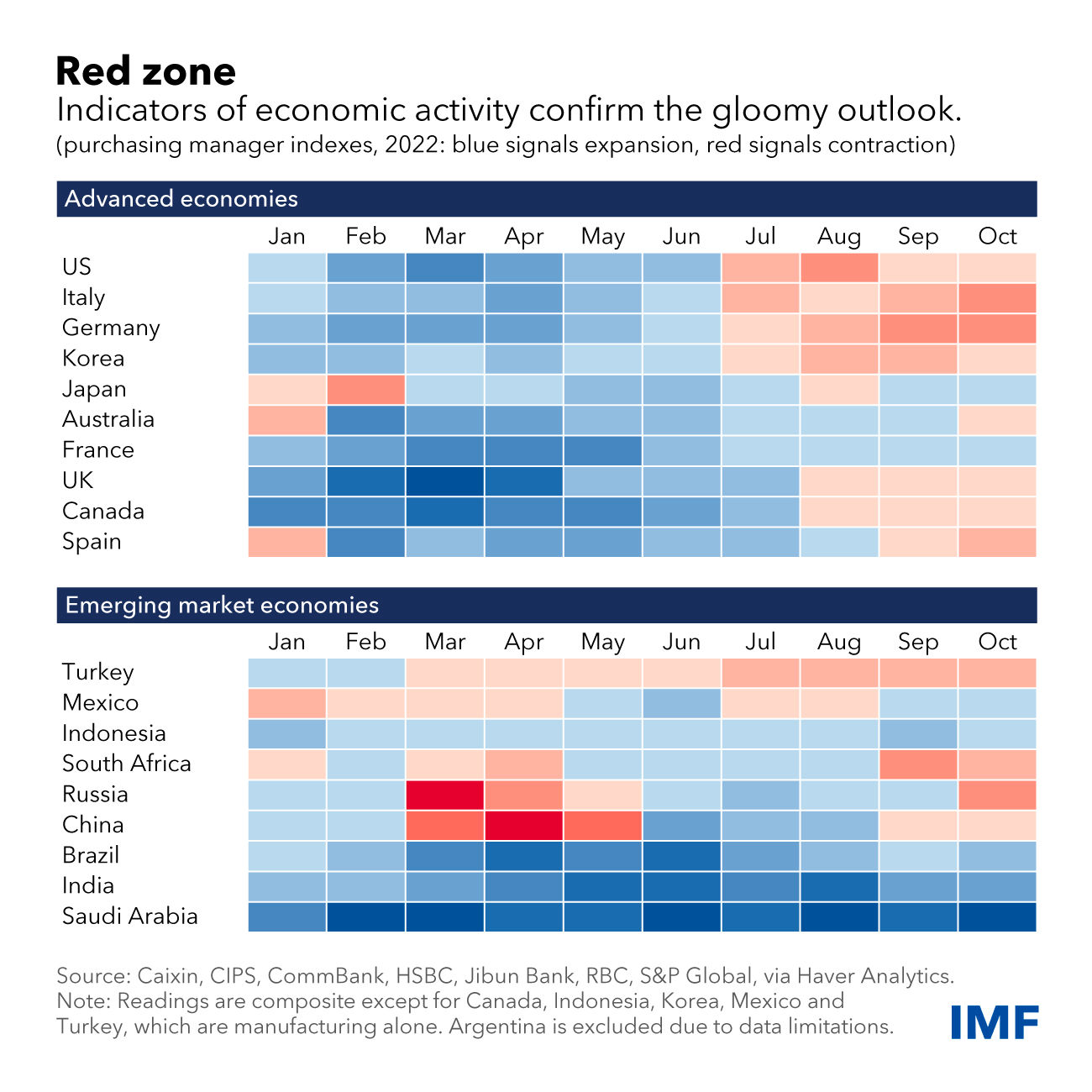

What stage are we at in the dollar milkshake theory? The U.S. dollar remains strong against global currencies. COVID-19, the war in Ukraine and China's supply-chain issues have resulted in an economic slowdown. The International Monetary Fund has reported a “gloomy outlook” for economic growth in 2023 as G20 countries have transitioned from growth to contraction. It is difficult to remain optimistic as Brent Johnson predicts this global sovereign debt crisis will get worse than the European Debt crisis and governments must be shocked into taking action before the dollar milkshake crisis becomes a reality.

To prepare for the potential crisis, some investors have looked to other real assets as a safe-haven, e.g., gold or cryptocurrency. In the next edition of the dollar milkshake theory, we will outline the impact this theory could have on cryptocurrency and its use cases during a sovereign debt crisis.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.