🌐 Why you should pay attention to Solana

This edition includes a special feature on the Solana ecosystem in addition to the ledger hack, a blockchain-based new authentication app and more.

In collaboration with Shoal Research, we present a special feature on the Solana Ecosystem.

Check out Shoal Research's substack and telegram channel!

🌐 The Growth of the Solana Ecosystem

What is it - During 2023, the Solana ecosystem experienced significant growth, marked by an uptick in on-chain transactions surpassing multi-year highs.

Why is this happening - Key factors contributing to Solana's continued expansion include its strong community, fast speed and low transaction costs. Recent activities, such as the JITO and Pyth airdrops, have also stimulated attention.

What does this mean - The trend towards Solana suggests that users prioritize low costs and ease of use, potentially at the expense of full decentralization and security. This preference indicates a shift in user priorities within the broader crypto sector.

Why it is interesting - Solana's potential for continued growth, particularly in a bull market, is notable due to its fast transaction throughput. This feature positions it as a strong contender in the market, especially when compared to Ethereum where transaction costs can remain high.

Keywords

JITO: Similar to LIDO on Ethereum, JITO is a liquid staking protocol for Solana.

Pyth: Comparable to Chainlink, Pyth is an oracle service that delivers market data.

Layer 1 Ecosystem: A foundational blockchain network that supports the creation and execution of decentralized applications and smart contracts directly on its own protocol.

Transaction Throughput: The rate at which transactions are processed on a blockchain, often measured in transactions per second (TPS)

More Information

NFT Growth: https://twitter.com/MessariCrypto/status/1734265687223476500?s=20

Solana Project Earnings: https://science.flipsidecrypto.xyz/solana-project-earnings/

Airdrop: https://twitter.com/ponzirespecter/status/1733536655993077991?s=52&t=txFAbiSPTdLLDlAYj9X_AA

Solana vs. Ethereum: https://twitter.com/tusharjain_/status/1733212944853307891?s=52&t=txFAbiSPTdLLDlAYj9X_AA

📈 BONK Coin Surge

Speaking of Solana, the Solana-backed token Bonk surged over 700% this month after Coinbase announced it would list the meme coin on its platform on December 14. It got an additional boost from Binance after the crypto exchange announced zero-fee trading for Bonk. The price increase has also revitalized sales of Solana’s Saga phone, which includes an airdrop of 30 million Bonk tokens with purchase. Bonk is currently the third largest meme coin by market capitalization behind Dogecoin and Shiba Inu.

🥷 Ledger Hack

Hackers drained about $500,000 worth of crypto on December 14 by inserting malicious code into Ledger’s Connect Kit that triggered a token drainer. Several decentralized finance protocols that use Ledger’s Connect Kit to connect dApps to its products were compromised including Lido, Metamask, Coinbase and Sushi. Ledger CEO Pascal Gauthier addressed the hack on the company’s blog stating that it was a former Ledger employee that fell victim to the initial phishing attack and it was “an unfortunate isolated incident.” Gauthier assured users that “Ledger will implement stronger security controls” and “continue to raise the bar for security around dApps.”

📸 News Authentication Use Case

Nodle, a decentralized smartphone network, has just released a blockchain-based media authentication app called Click. The app would serve the media sector by requiring users to authenticate content using the Click app camera, which is then signed and recorded on the Nodle blockchain. This process would make it impossible to circulate fake or AI generated photos and videos on the platform. Click is a member of the Content Authenticity Initiative led by Adobe and the Linux Foundation and is currently available on the Apple App Store.

⚖️ Nirvana Hacker Convicted

The first-ever conviction for a smart contract hack has been laid on a software engineer who pled guilty to hacking Nirvana Finance and another unnamed decentralized crypto exchange. In July 2022, Shakeeb Ahmed, a former security engineer for an international technology company, inserted fake pricing data to fraudulently cause the unnamed crypto exchange to generate approximately $9 million worth of fees, which Ahmed then withdrew. A few weeks later, he exploited a bug in Nirvana Finance’s smart contract and stole approximately $3.6 million. Ahmed has since agreed to pay restitution and his guilty plea could result in a maximum sentence of 5 years in prison.

💰CoinList Settlement

CoinList, the crypto exchange and coin listing service, has agreed to pay $1.2 million in a settlement with the U.S Treasury Department for allegedly violating Russia/Ukraine sanctions. Between April 2020 and May 2022, CoinList processed 989 transactions on behalf of users from Crimea which they did not reject or self-report. The Treasury Department concluded that CoinList “conferred economic benefits to Crimea” with no indication that the transactions were licensable or involved in humanitarian activity.

📚 N+1 Recommendations

The N+1 reading and media recommendations are sourced from our team of experts and offer weekly suggestions for learning more about blockchain, crypto, finance and technology.

This weeks recommendation is Gemini’s 2024 Crypto Trend Report

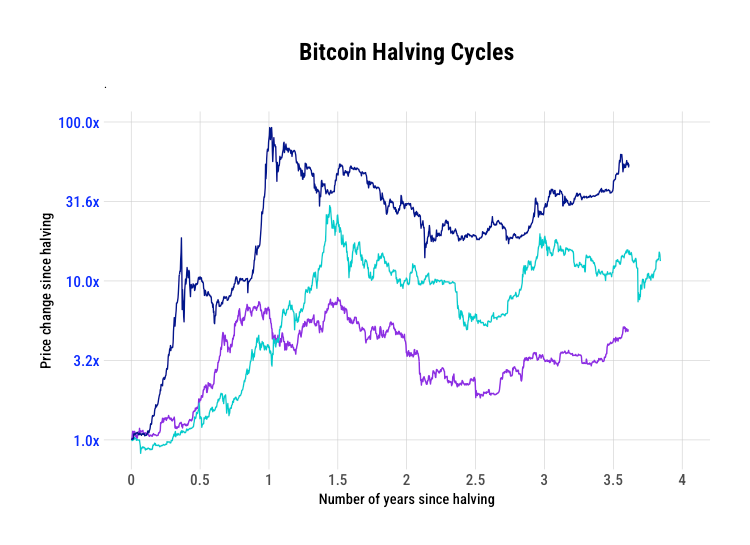

📊Charts of the Week

🤩 This week on X (formerly Twitter)

JUST IN: 🇺🇸 Valkyrie filed it’s fourth amendment to it’s spot #Bitcoin ETF with the SEC 👀 pic.twitter.com/tn4hLbXsfi

— Bitcoin Magazine (@BitcoinMagazine) December 14, 2023

Nasdaq just crossed all time highs in the futures market pic.twitter.com/5rAj1miBk6

— Will (@WClementeIII) December 14, 2023

BlackRock met again with the SEC yesterday. This time with Gensler's people/staff https://t.co/cjQ8ChxlBV pic.twitter.com/shDiZPidPe

— James Seyffart (@JSeyff) December 15, 2023

Targeted approval phishing scams are on the rise, with many fraudsters using romance scam tactics to trick victims into signing malicious TXs. We estimate victims have lost over $374M in 2023. Learn more in our first 2024 Crypto Crime Report preview https://t.co/5cRD7VgNrN

— Chainalysis (@chainalysis) December 14, 2023

🚨Join the conversation

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.