Crypto's collapse: It's not a crypto problem, it's a greed problem.

The fall of crypto exchanges harkens back to Long Term Capital Management's massive failure in the 90s.

“Bow before the king” Do Kwon, founder of Terra Labs, tweeted on December 30, 2020, 16 months before the Terra ecosystem death spiraled. The collapse of Terra Labs in May 2022 and ensuing panic set off a cascade of sell-offs in which no crypto exchange was safe. On July 1 2022, Three Arrows Capital filed for bankruptcy, causing a ripple effect felt by other exchanges, namely Voyager Digital, Genesis, and BlockFi.

Crypto is a volatile asset class, yes. However, the downfall of major crypto exchanges was not a crypto problem, it was a human problem. And if history has taught us anything, it is that human error and greed play a major role in the market, despite our trust in software, algorithms and historical data. An example? The colossal downfall of Long Term Capital Management.

Long Term Capital Management

In 1994 a veteran trader assembled several prestigious economists including two Nobel Prize recipients to create a new kind of hedge fund, one that would employ the latest financial theories and quantitative models to beat the market. The fund, Long Term Capital Management (LTCM), used sophisticated models to find two similar assets: one cheap, the other expensive. It bought the cheaper asset and shorted—i.e., borrowed from someone else and sold—the more expensive one. At the core of LTCM’s models was a rational expectation and assumption: prices of similar assets must converge.

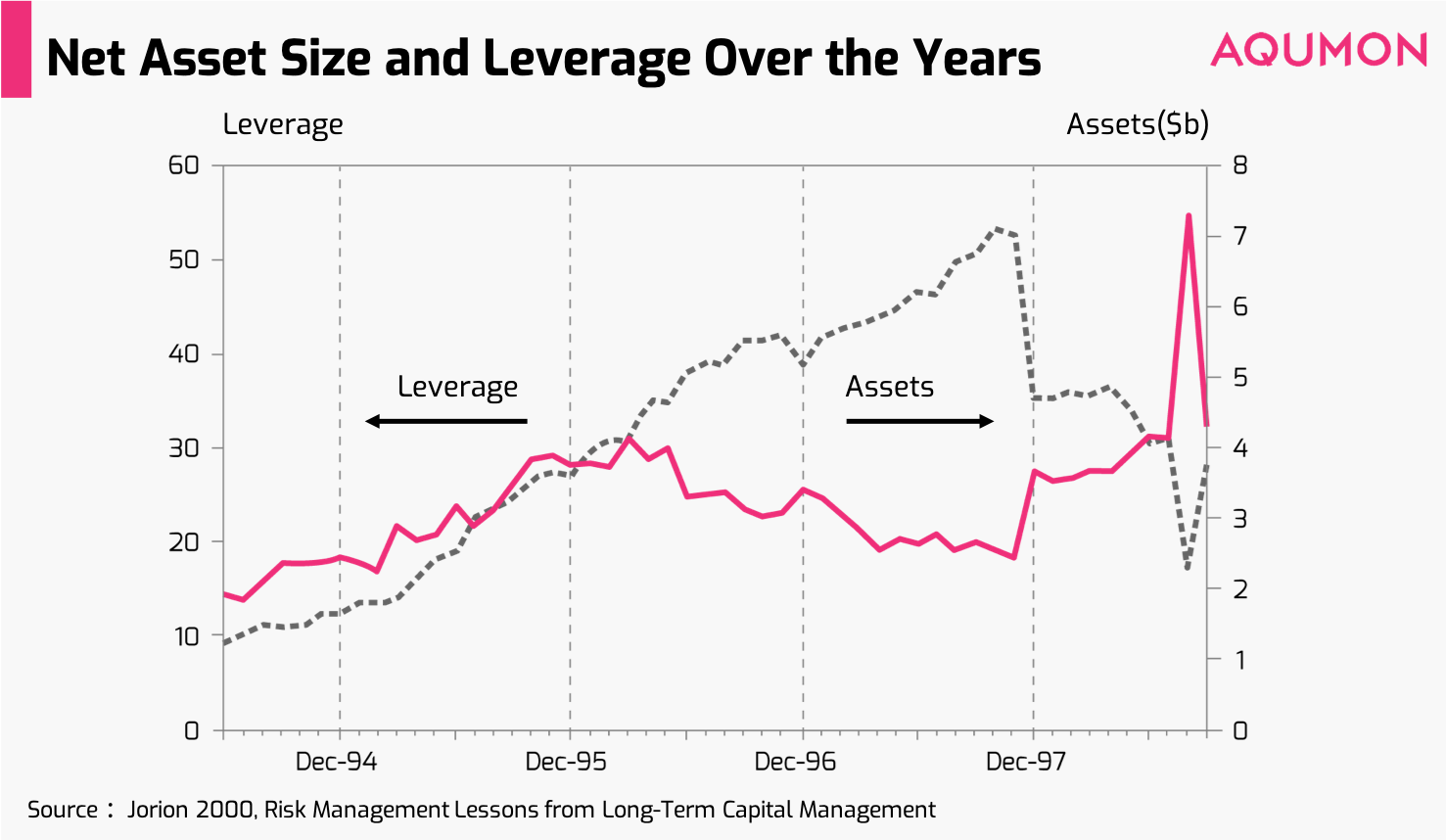

LTCM’s quantitative models had another core feature: extremely high leverage—i.e., substantial use of borrowed capital. In 1998, LTCM had about $5 billion in equity and had borrowed about $125 billion. LTCM had to use high leverage to earn high returns because the price difference of similar assets is usually very small. High leverage means high risk but LTCM’s portfolio was hedged almost perfectly: it bought and shorted similar assets. Risk was minimal. According to Lowenstein, author of When Genius Failed: The Rise and Fall of Long-Term Capital Management, LTCM’s risk models estimated that the fund would not lose more than $45 million in one day. The probability that it would lose all of its capital in one year was 1 in 1024 (a trillion trillions).

LTCM’s models worked remarkably well for about four years. The hedge fund grew at an average rate of over 40% during this time. Then, in August 1998 almost all of LTCM’s trades went sour. The first domino fell on Aug 17th when Russia defaulted on its domestic debt. In LTCM’s models, the probability that Russia would default on its debt was extremely low. By the end of the month, the fund had already lost about $2 billion in equity.

When Russia defaulted, fearful investors wanted to hold safer assets so they moved their capital away from cheap assets to expensive assets. LTCM’s models failed to anticipate this kind of “irrational” behavior. The prices of cheap and expensive assets began to diverge more and more, forcing LTCM to liquidate its positions. A quote from Keynes captured it best: “The market can stay irrational longer than you can stay solvent.” The fund lost almost all of its capital and was itself teetering on the brink of default because of its flawed models and high leverage. The Federal Reserve decided that LTCM’s failure would pose a serious threat to the global financial system and orchestrated a $3.5 billion bailout package.

LTCM vs. Terra Labs

LTCM and Terra Labs bear similarities, like the use of cutting-edge technology, large initial investments, a largely unregulated environment and a bold and overconfident leadership team. After raising around $200 million for Terra Labs, Do Kwon began creating a name for himself in the crypto world, but not for good reason. Kwon has been known to call critics of his stable coin “poor,” at one time tweeting: “I don’t debate the poor on Twitter, and sorry I don’t have any change on me.” Ironic now that Kwon claims he has lost nearly “all his wealth” in the Terra crash.

Terra Labs created UST, an algorithmic stable coin which pegs its value against Luna, its partner coin. To encourage the purchase of UST, Terra Labs set up a DeFi protocol called Anchor that gave users a 20% return if they deposited UST. Like LTCM, the math works under normal market conditions. However, during periods of volatility and one-sided buy or sell activity, UST can lose its peg. And that is exactly what happened. Because of high yields, hundreds of millions of UST were sold on Anchor. UST depegged and investors panicked. On May 12, 2022 Luna dropped 96% in one day and never recovered.

The fall of Terra Labs demonstrated the dangers of arrogance, hubris and blind trust in algorithmic models, as well as instigated a tidal wave of destruction in the crypto world. When Terra Labs succumbed, panic ensued and investors began selling their risky assets. LTCM triggered a similar market downfall as the S&P dropped 19.3% before the bailout.

Overleveraged and over confident

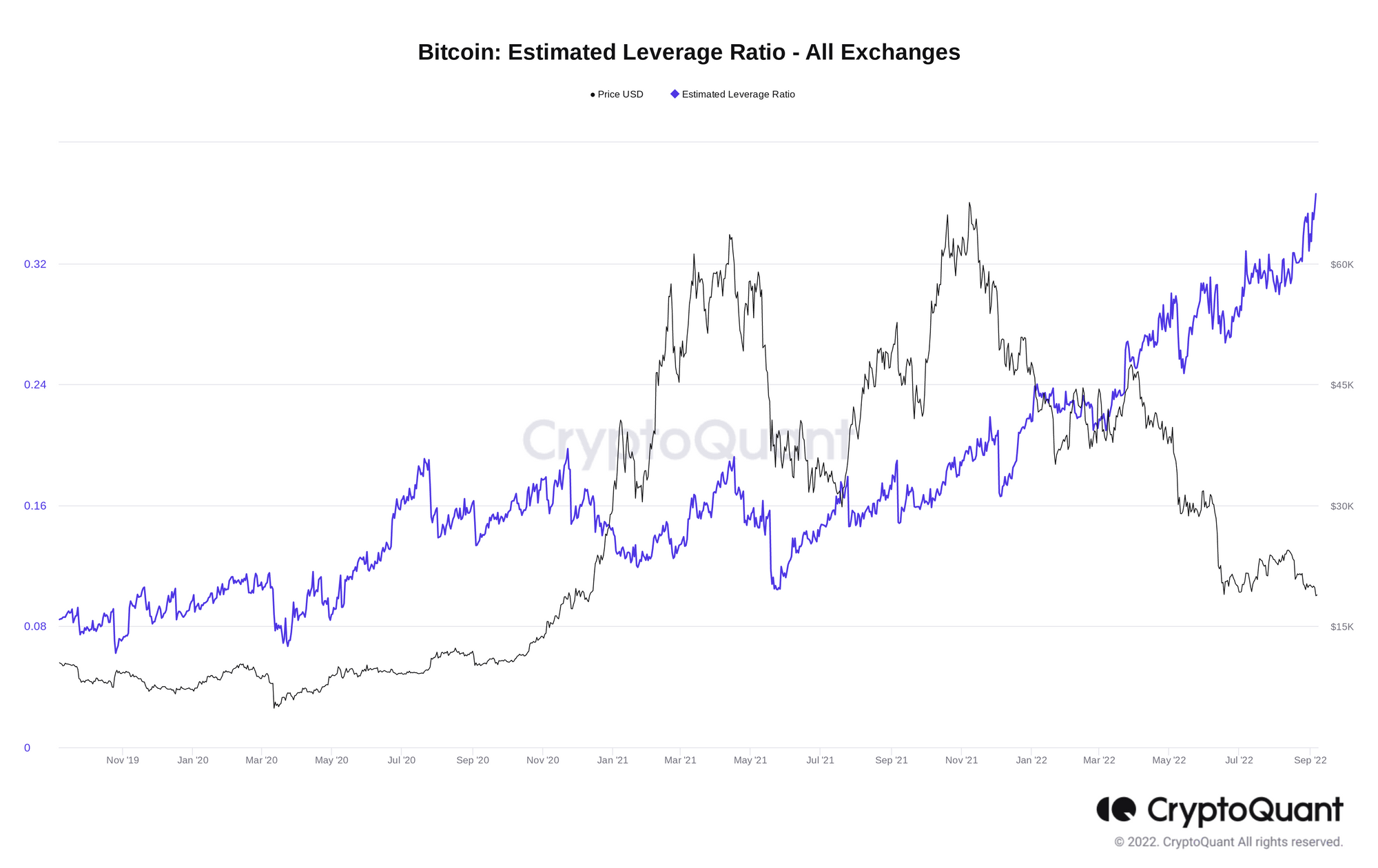

Like the case of LTCM, the distinguishing factor in the fall of subsequent crypto exchanges was leverage. Overleveraged trading often leads to a price crash, especially if market conditions cause traders to liquidate at once. Three Arrows Capital (3AC), the $10 billion hedge fund, was the first exchange to bear the brunt of simultaneous liquidation.

The founder of 3AC and former owner of $150 million superyacht “Much Wow”, Su Zhu, has been likened to Kwon for his big bets, risky plays and overall delusion. An invariable believer in the “crypto super cycle”, Zhu used aggressive leverage to maximize growth and potential returns. 3AC’s primary investment strategy involved borrowing money across the industry and investing that capital in other crypto projects, including an estimated half a billion in Terra Labs’ Luna token. Once Terra Labs collapsed in May 2022, lenders, like Blockchain.com, began to inquire about 3AC’s exposure. Zhu assured lenders there was nothing to fear. However, when firms began to callback their loans, they were ghosted.

On July 2, 2022, as bitcoin traded below $20,000, 3AC filed for bankruptcy. Exchanges exposed to 3AC include Blockchain.com, Voyager Digital, Genesis, and BlockFi. The crypto crash sent shockwaves throughout the industry and exchanges responded by halting transactions, laying off employees, and/or filing for bankruptcy.

The aftermath

The ensuing fallout is palpable as the crypto winter ravages on. Bitcoin remains trading under $20,000, with an upswing not expected until later in the new year. LTCM, Terra Labs and 3AC share marked similarities in their unbridled confidence and hubris. In the crypto world, risky investment strategies coupled with rising inflation and overall market pessimism created an environment where a crypto collapse was inevitable.

“In a new, innovative space, this type of collapse follows a natural course of events,” says Dr. Sandy Green, Chief Investment Officer at N+1 Analytics. “This event, while traumatic, will make the space stronger.” Dr. Green likens the collapse to the fall of Mt. Gox in 2014: “After that, exchanges became more secure. This is what helps new systems evolve and develop.”

However, if the mistakes of LTCM resonated with crypto tastemakers like Kwon and Zhu, the crypto downfall may not have been as disastrous. Elegant theories and mathematical models of risk may give us a sense of confidence but they fail to capture and assess the messy and uncertain real world. This collapse teaches us about the vulnerability of our models of reality to ill-conceived assumptions. It also shows us that hubris loosens our grip on reality often leads to dire consequences.

"Although we should learn from events like these, history repeats itself, or at least it rhymes," says Albert Szmigielski, Chief Technology Officer at Nplus1 Analytics. "Greed and hubris will continue to influence markets and related events for as long as those decisions are guided by emotions."

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.