How Stablecoins like USDT and USDC are Reshaping U.S. Treasury Markets

The stablecoin market has entered a new phase. With stablecoin regulation advancing in Congress and bipartisan consensus forming around clear guardrails, we are witnessing the contours of America’s first comprehensive stablecoin framework. While compliance is helpful and needed for the crypto industry, the critical story emerging lately is about how digital dollars are growing as one of the U.S. Treasury’s most important sources of demand.

The Increasing Treasury–Stablecoin Connection

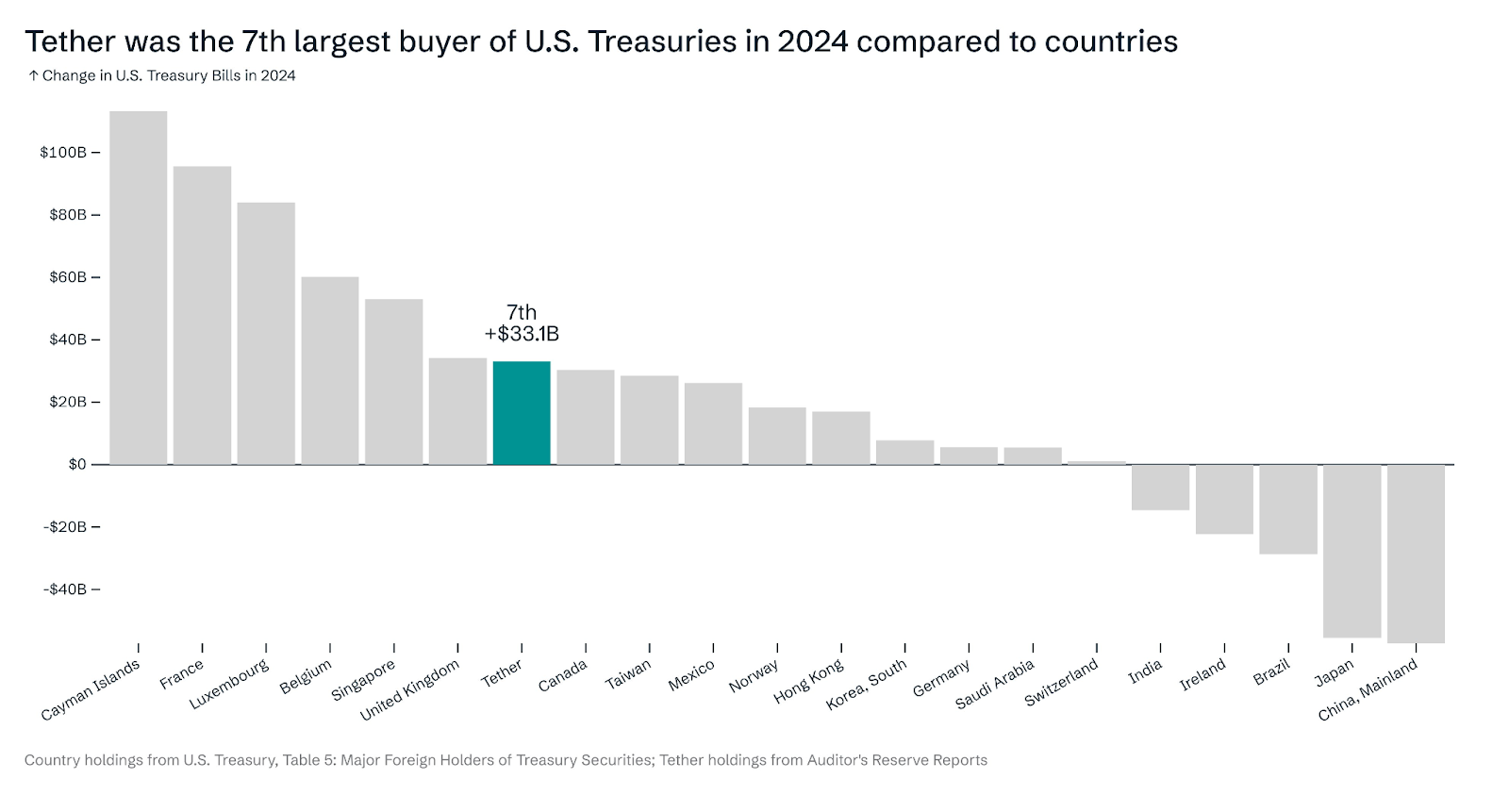

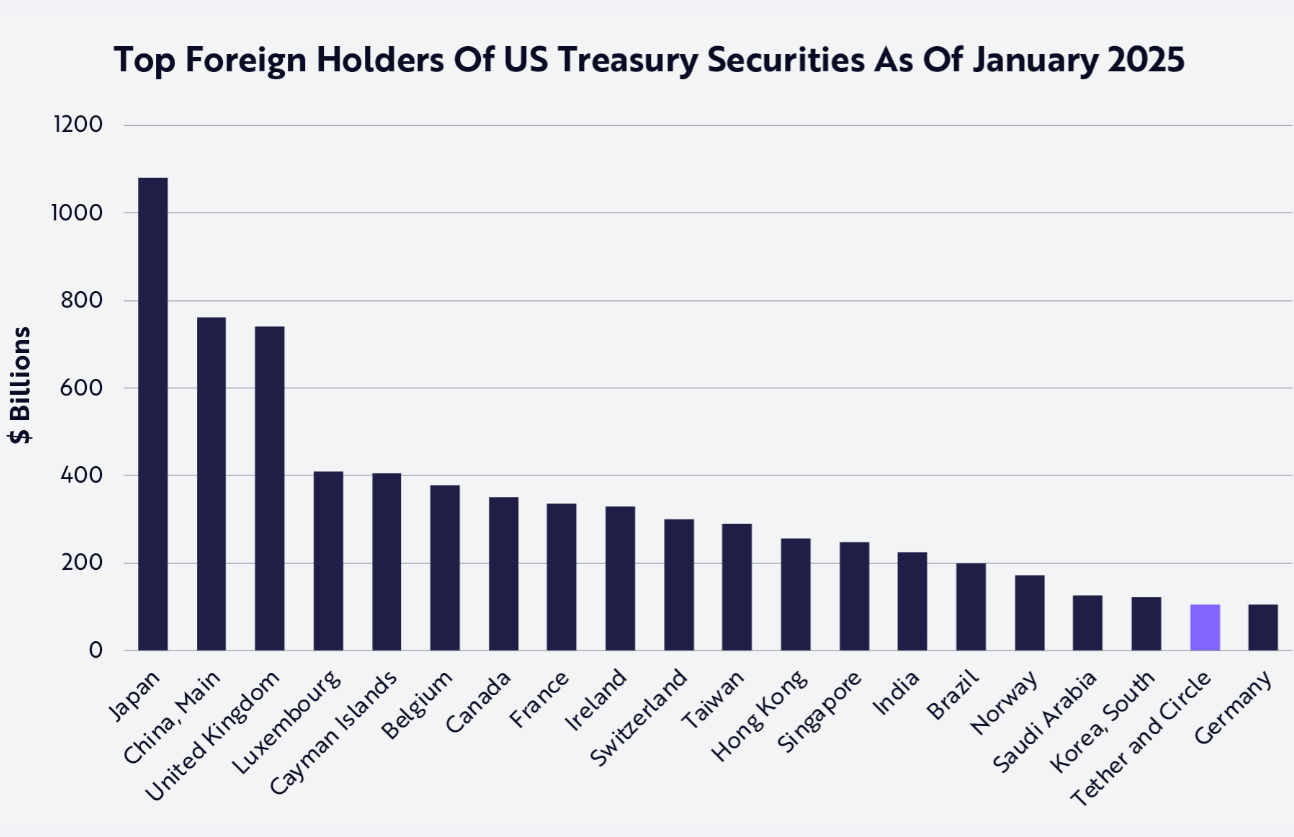

Stablecoins are now a quiet cornerstone of demand for U.S. government debt. Tether alone reports over $120 billion in Treasuries, surpassing the holdings of many nations. To put it in perspective, stablecoins are now comparable to sovereign investors in scale. In 2024, Tether bought more Treasuries than Canada and Taiwan, making it the 7th largest purchaser.

This happens because every dollar-pegged token, such as USDT and USDC, must be backed by cash-equivalent reserves, primarily short-term Treasuries. Once the market approaches $750 billion, stablecoins could begin reshaping Treasury dynamics. With the market around $240 billion today, and growing at double-digit annual rates, that threshold is in sight.

This reserve model has made Tether alone billions in profits, even as it creates a stable bid for U.S. debt at the short end of the curve—a new structural force that financial markets cannot ignore. As of January 2025, Tether (USDT) and Circle (USDC) together were #19 among the top 20 foreign holders.

From Gray Area to Green Light: Stablecoin Regulation Is Here

The era of regulatory ambiguity for stablecoins has officially ended. The long-awaited GENIUS Act, signed into law by President Trump on July 18, 2025, has established a clear federal framework for these digital assets.

This landmark legislation sets a "bank-like" standard for stablecoin issuers, mandating that all stablecoins be fully backed on a 1:1 basis with cash or short-term U.S. Treasury bills. The law also requires monthly third-party audits and public disclosures of reserve holdings. The crypto community had been calling for these types of practices through self-governance since the inception of stablecoins like Tether. This legislation mandates a new level of transparency and trust.

For investors, this shift offers a significant opportunity. The regulatory clarity provided by the GENIUS Act transforms stablecoins from a speculative crypto niche into a secure, federally-recognized asset class. By reinforcing the U.S. dollar's role in the digital economy, this legislation positions stablecoins as a key tool for global financial transactions, all under the reliable umbrella of U.S. law.

The Treasury–Stablecoin Flywheel

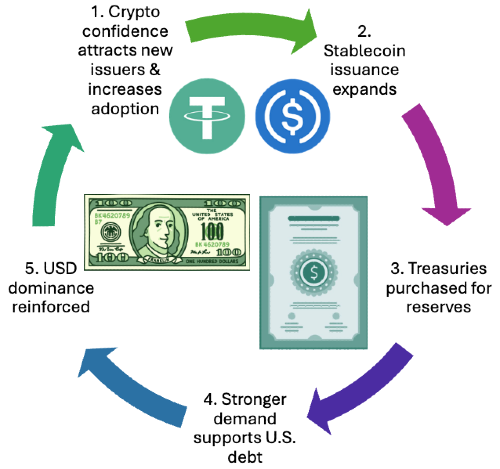

Stablecoins have created a feedback loop that ties the digital asset world directly into U.S. government and global finance. Every new stablecoin issued must be backed by highly liquid, safe assets—most often Treasury bills. That means a dollar of new stablecoin demand becomes a dollar of fresh demand for U.S. debt.

This steady bid helps support Treasury prices and anchors confidence in the dollar’s role as the dominant reserve currency. The stronger that confidence grows, the more attractive stablecoins become for payments, trading, and global remittances. That, in turn, draws in new issuers—whether banks, fintechs, or regulated offshore players—who once again must buy Treasuries to back their reserves.

The result is a reinforcing cycle: stablecoin adoption drives Treasury demand, Treasury demand reinforces U.S. fiscal strength and dollar primacy, and that primacy attracts even more adoption.

The Tariff Connection: A Double-Edged Dollar Strategy

Trump's tariff strategy adds another layer to this stablecoin-Treasury nexus. The administration projects tariffs to increase federal tax revenues by over $150 billion in 2025, making them the largest tax hike since 1993. This level of revenue remains to be seen, of course. However, tariffs create a paradox: while they generate revenue, they can also trigger economic volatility that increases demand for dollar-backed stablecoins as safe havens.

A rise in inflation, tightening of supply chains, or increase in economic volatility can boost demand for stablecoins. This creates a fascinating dynamic where tariff-induced uncertainty actually strengthens the Treasury-stablecoin flywheel. Representatives of the Treasury and the Federal Reserve have emphasized that stablecoins could reinforce the dollar's primacy by creating new demand for U.S. Treasuries, since almost 99% of stablecoins are dollar-denominated.

Global Competition and Tokenized Treasuries

The U.S. is not alone in shaping this future. Europe’s MiCA framework has already authorized euro-backed stablecoins. Asia (Hong Kong, Singapore, UAE) is positioning itself as a hub for regulated digital assets. At the same time, another trend is accelerating: tokenized Treasuries. Products like BlackRock’s BUIDL fund, Ondo’s tokenized T-bills, and similar offerings in Asia have grown into a multi-billion dollar market in under two years. Investors increasingly ask: why hold a stablecoin earning 0%, when you can hold a tokenized Treasury yielding 5%? all this suggests a bifurcated future: stablecoins for payments and liquidity, tokenized Treasuries for savings and yield.

Risk: A Market That Can Cut Both Ways

Stablecoin growth presents significant risks, potentially creating new vulnerabilities in the U.S. Treasury market. Critics warn of financial instability if the market is stressed, as Treasuries might not remain safe assets for issuers. A major stablecoin issuer's collapse could trigger "run risk" from panicked customers, forcing mass Treasury dumping and destabilizing the market, similar to 2008 money market fund issues. This demand also risks dangerous shortages of Treasury bills during financial stress. Policymakers also haven't fully addressed potential government bailouts or the risk of reserves diversifying into riskier assets like commercial real estate if fractional reserve rules are applied.

The Digital Dollar’s Destiny

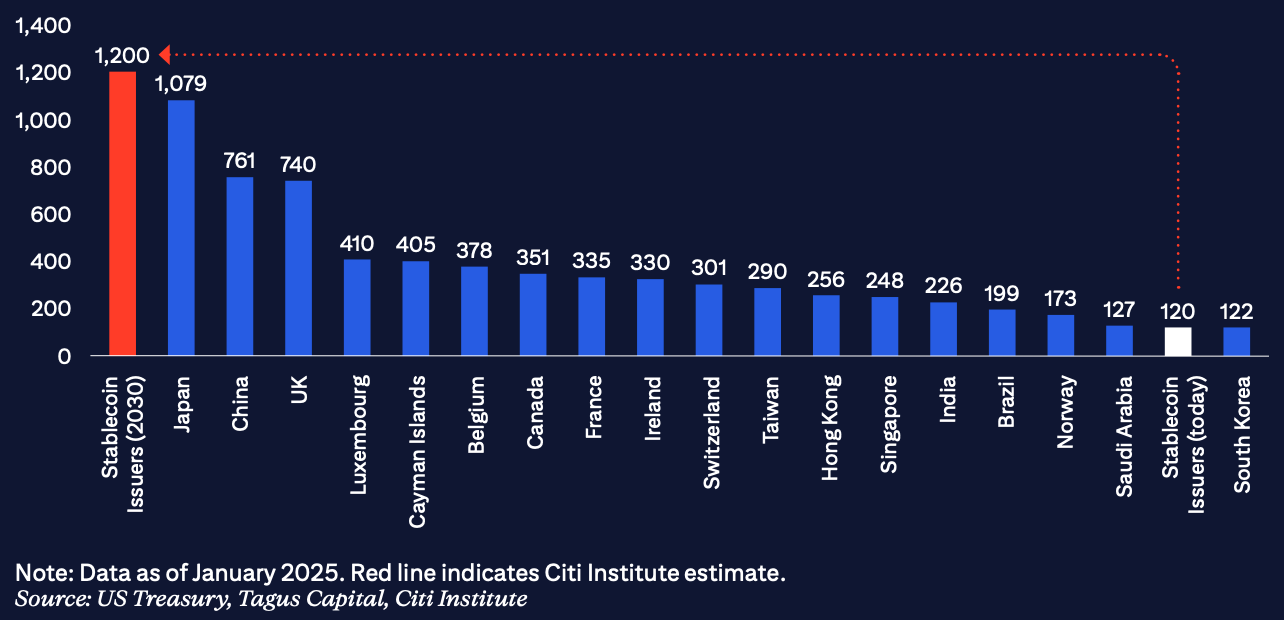

Despite these risks, the momentum is in the direction of long-term growth. Stablecoins are evolving from a crypto novelty into institutional-grade, dollar-exporting infrastructure. They represent the market’s answer to the debate over a central bank digital currency: a privately issued, regulated, and dollar-backed digital money system that extends U.S. financial reach across borders. Forbes projects stable coin issuers could surpass all countries, including Japan and China, by 2030.

The takeaway is simple:

For investors: this is not just about crypto—it is about a new, structural source of Treasury demand.

For policymakers: stablecoins are financial statecraft, fusing U.S. debt issuance and dollar dominance with digital money rails.

The question is no longer if stablecoins will reshape Treasury markets. It is how fast the flywheel spins. And whether tokenized Treasuries and foreign regulation will challenge or strengthen America’s first-mover advantage.