Ethereum price crashes following merge

Ethereum’s long-awaited merge was a success! Why did the price collapse?

Ethereum’s ambitious move from proof-of-work to proof-of-stake was successfully completed September 15, 2022, making the network 99% more energy efficient with increased security and scalability. Failure could have meant disrupted trade, a drop in crypto markets and a loss of faith in the technology.

So, if the merge was a success, why did the price of ETH tank? In the days following the merge, the price of ETH dropped nearly 20%. Bullish traders anticipated increased demand and higher ETH prices due to lower supply and higher yield staking. Long-term this is still expected to hold true as ETH’s deflationary cycle adjusts supply and demand. But, short-term there are a few factors that led to ETH’s price drop.

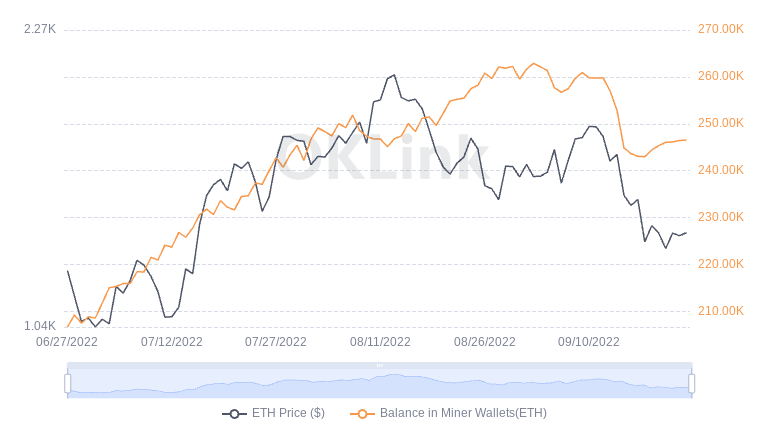

Ethereum is suffering from a “sell the news” effect – when traders purchase an asset before a price-moving event and dump it afterward. Sell the news events are characterized by high volatility and a drop in prices after hype mitigates. Traders purchased ETH ahead of the merge hoping the price would rise and sold after the event. Also, ex-miners dumped ETH at record levels – 17,000 ETH since the merge. Instead of liquidating regularly, miners held onto their ETH in hopes of selling it for a profit post-merge. Now, they are moving funds from their cold wallets into the market.

This massive sell-off combined with the macro economic environment has caused ETH to plummet. Traditional markets and crypto markets have become correlated during the covid pandemic. Macroeconomic factors like soaring inflation and reactionary interest rate increases impact both equally. As the S&P 500 dropped, so did BTC and ETH. On Sept. 21, the Federal Reserve announced they would raise interest rates again by 0.75 percentage points. With this news, we will see a general trend of investors avoiding riskier assets, like cryptocurrency.

The good news – this trend is likely short-term. The new and improved Ethereum network can only help ETH’s appeal. Once the short-term sell-offs are absorbed, the deflationary cycle of ETH should balance supply and demand.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.