Cryptocurrency in an economic downturn

How does crypto fare in the context of stagflation?

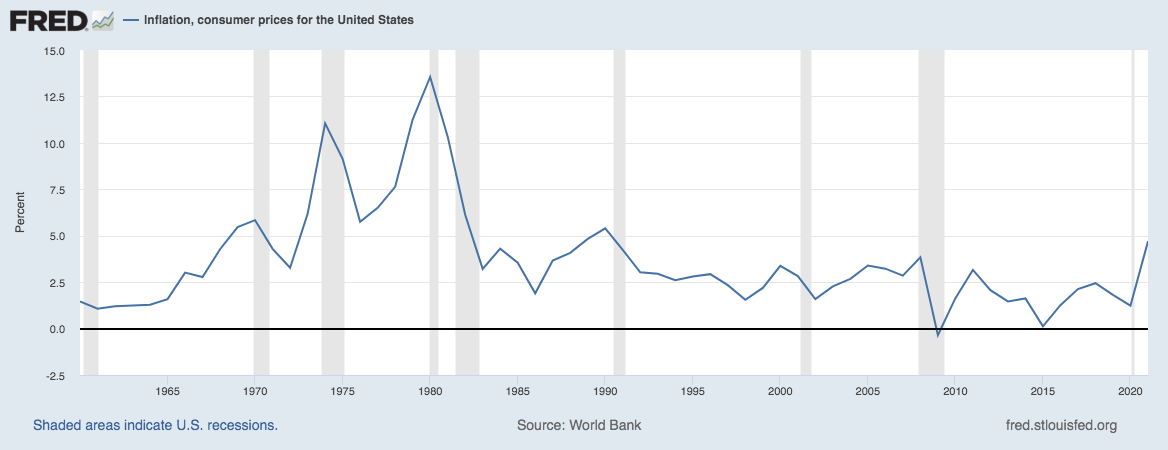

Prices of goods and services continue to rise as Covid-19 and the war in Ukraine put immense pressure on global supply chains. With slow economic growth this puts economies at risk for stagflation - a phenomena with high prices and high unemployment rates not seen since the 1970s. In May, the US inflation rate hit 8.6%, a 40 year high. With investors tightening their wallet, how are risky assets, like cryptocurrency faring?

Bitcoin’s great fall

As bitcoin goes, so does crypto. In 2022, Bitcoin fell over 70% to just below $18,000 by June 20 since its all-time high (ATH) of $67,553.95 USD in November 2021. Total cryptocurrency market cap fell below $1 trillion USD, the lowest valuation since January 2021. Investors have lost millions and Bitcoin’s Fear and Greed Index has indicated Extreme Fear for weeks. This crash is unlike other market resets as cryptocurrency’s entrance into mainstream culture means more people and institutions are affected.

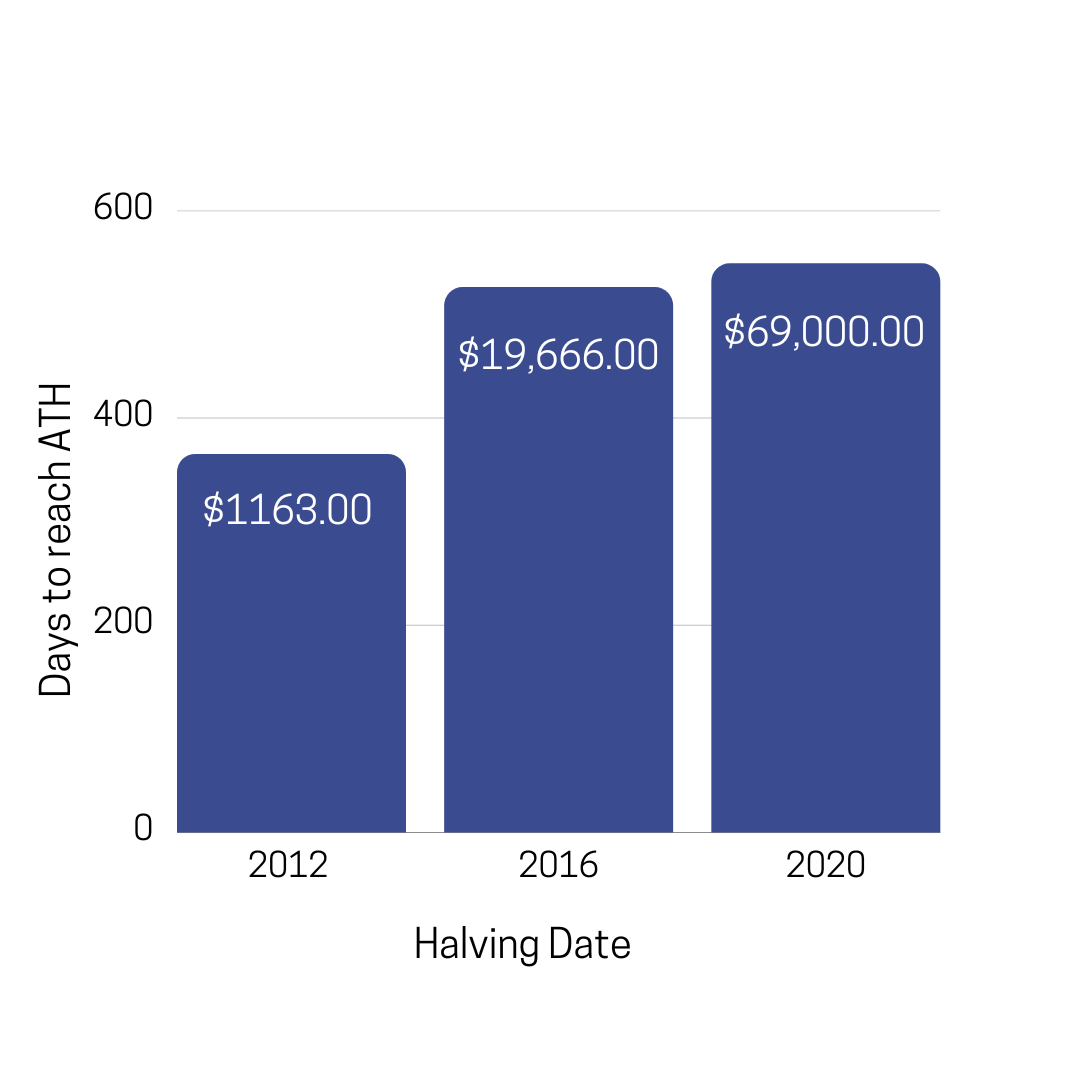

Shortly after bitcoin’s November ATH, bitcoin began trading sideways with no clear direction. Some investors remained bullish, largely due to the lengthening price cycle theory. This theory suggests that when measured from a cycle’s market bottom, the time it takes for bitcoin to reach its cycle peak is lengthening. N+1 calculated how long each halving cycle took to reach its peak from the beginning of the cycle:

The data suggests a lengthening price cycle. However, bitcoin failed to reach another all time high following its November peak and a 4.4% differential in time may not represent a statistically significant change. Even Benjamin Cowen, the eternal optimist and major proponent of the theory, admitted defeat in a single tweet.

#Bitcoin Lengthening cycles is dead. Bear market has been here for months and will likely continue to rage on for a while.

— Benjamin Cowen (@intocryptoverse) May 7, 2022

Let’s hope this is a macro bottom signal, but I don’t think it is.

There are a number of external factors that lead to the crypto “bloodbath” - primarily crypto’s increasing ties to US markets and overall economic uncertainty.

- Cryptocurrency’s relationship with traditional markets

In March 2020, the early days of COVID-19, we saw a strong indication that bitcoin and traditional markets were moving in tandem. Covid fear triggered a significant plunge in both traditional and crypto markets, creating a strong correlation between both asset groups for the first time. Central banks and governments responded and covid stimulus quickly outpaced that of the 2008 financial crisis. Global money supply increased and this excess liquidity created sufficient conditions for traditional and crypto markets to remain correlated during the upswing and price rebound too.

2. Response to inflation

A culmination of fiscal spending during covid, supply constraints from the war and China’s zero covid policy has accelerated inflation rates. In May, the US inflation rate hit 8.6%, raising the price of necessities from fuel to eggs and milk. In response, on June 15 the Central Bank announced it would raise interest rates by 0.75% - the largest hike in more than 25 years. There has been a pullback on riskier assets, like cryptocurrency, causing prices to drop.

3. Moves by institutions like Celsius and Coinbase

The failure of institutions to prepare for crypto winter has added to investor fear and uncertainty. On June 13 crypto lender Celsius froze all account withdrawals due to “extreme market conditions” and is now working with lawyers on a ‘restructuring’ plan. Coinbase fired 18% of its employees, Gemini cut their staff by 10% and BlockFi laid off 20% of its workforce, among others.

4. Over-leverage

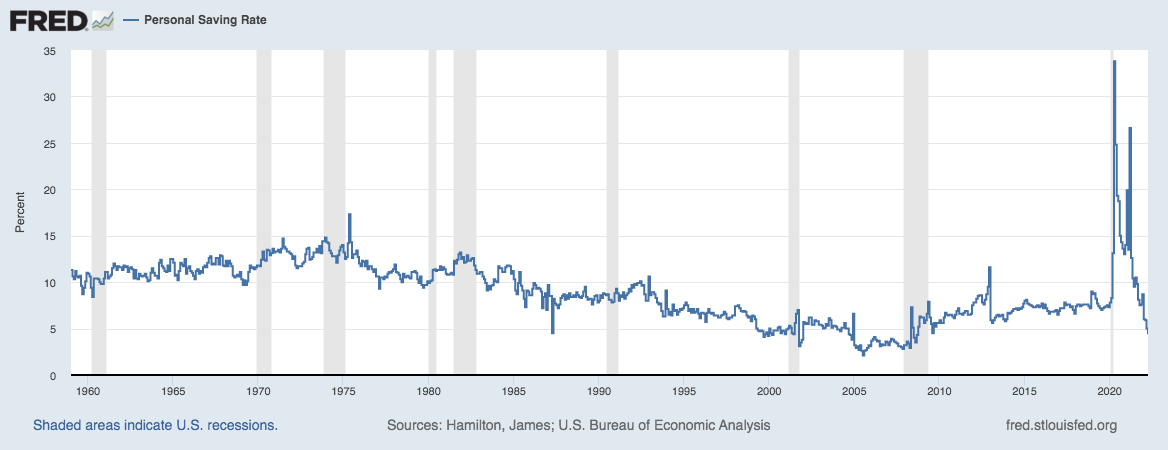

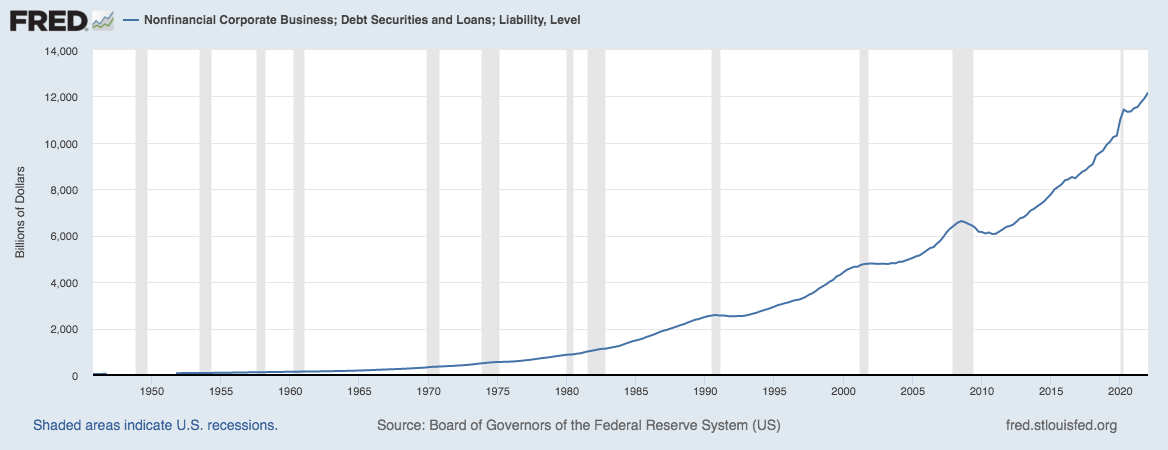

We are a highly indebted society. Not only individuals, but corporations as well. Crypto prices are in part driven by leverage trading, where capital is borrowed from crypto exchange brokers. Investors can borrow up to 100 times their account balance, depending on the crypto exchange and traditional stock investors have a maximum leverage of 50% of the value of a position.

Not only that, but the exchanges themselves may be piling on debt to keep up with innovation and the current crypto craze. The unregulated nature of crypto exchanges makes it difficult to tell how many of these transactions are leveraged. Similar to the 2008 subprime mortgage crisis, a highly indebted society and rising interest rates could lead to corporate busts.

5. Media coverage

Crypto has exploded in popularity. Although crypto winter is a well-known phenomena, extensive coverage has exacerbated this downturn. The last crypto winter from 2018-mid 2020 did not receive nearly as much media coverage.

Will crypto recover?

Considering blockchain development and increasing adoption, the crypto market will likely rebound. Cryptocurrency prices are cyclical and crypto winter is not a new phenomena. However, a poor macro economic outlook makes this crypto downturn particularly detrimental. If inflation and high interest rates continue, we could see bitcoin spend an extended period in the 20s and more time in the teens. In our last article, we outlined bitcoin’s halving cycles, and what it means for your investment. Our modeling suggests prices will increase a year before the next halving with potential frontrunning - approximately May 2023. Because cryptocurrency is increasingly tied to traditional markets, it is difficult to predict its recovery as we face economic uncertainty. Until then, hunker down because it could be a long winter.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.