Crypto regulation by country

Crypto adoption has skyrocketed the world over - how are regulators adapting?

Approximately 300 million people own cryptocurrency worldwide and that number is expected to reach 1 billion by the end of 2022. In the United States alone, 16% of people say they have invested in, traded, or used cryptocurrency. Bitcoin has been around since 2009, but only in recent years has cryptocurrency begun to go mainstream. With adoption rates soaring, lawmakers face uncharted territory when assembling a regulatory framework for this novel asset class.

Why is crypto adoption skyrocketing?

Reasons for adopting cryptocurrency vary from person to person. For some, it is an opportunity to invest in an emerging asset class. Others may wish to sever their reliance from centralized institutions. Many invest in blockchain technology itself, its various applications and its potential to disrupt current economic, social and political systems. Others identify with bitcoin’s libertarian roots, and want to be a part of a technological revolution built on decentralization and trustless computation rather than centralized institutions. This characteristic is becoming more relevant as cryptocurrency becomes a way for those living in politically and economically unstable territories to transfer funds, earn a wage and purchase goods without relying on central banks. In Afghanistan, most women and girls are not allowed to open a bank account. To circumvent this, many have created crypto wallets. In Ukraine, when traditional crowdfunding platforms refuse donations funding military operations, cryptocurrency has become a powerful alternative. So far, over $60 million in cryptocurrency has been donated to help Ukrainians combat Russian invasion.

As more people adopt cryptocurrency worldwide, governments are taking notice. Some jurisdictions take the hostile route while other countries embrace its various use cases. In many countries, regulation is up in the air as lawmakers attempt to grapple with the benefits and risks of allowing cryptocurrency adoption and trading in their jurisdictions. Concerns over terrorist funding, tax evasion and criminal use have led to absolute bans while other regions have quickly integrated cryptocurrencies into existing financial systems.

Regulatory Map

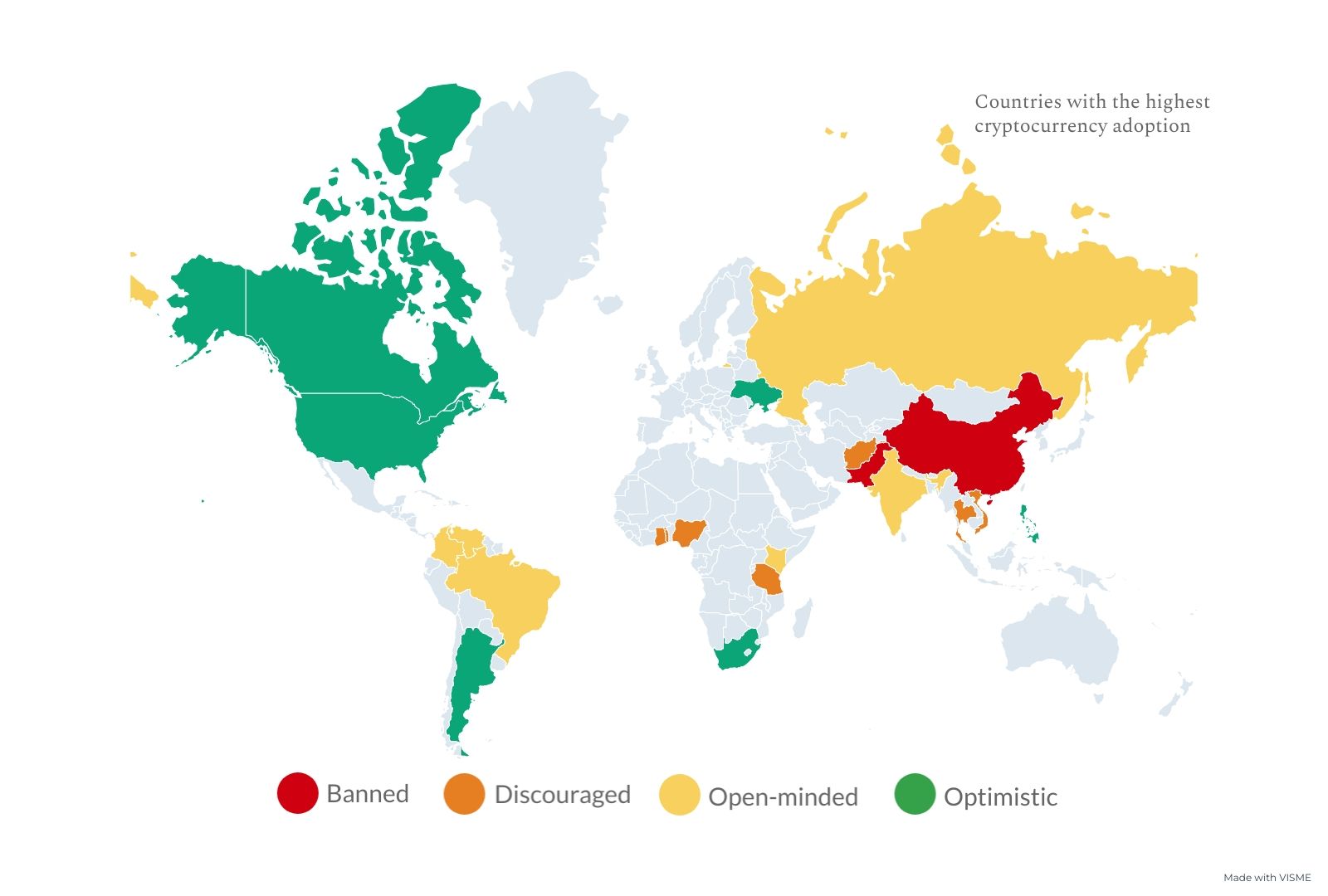

Our map includes 20 countries with the highest adoption rates (and Canada) and states the regulatory policy for each. Attitudes are categorized as:

- Banned- An absolute ban on cryptocurrencies

- Discouraged - Implicit ban on cryptocurrencies which includes prohibiting banks and other financial institutions from dealing in cryptocurrencies or banning cryptocurrency exchanges. Cryptocurrency use is discouraged, but not illegal.

- Open-minded - Regulations are forthcoming, or they have been recently established. Governments are open-minded, but cautious.

- Optimistic - Regulations are in place and governments see opportunity in cryptocurrency and accompanying technologies.

Regulations for the top ten countries with highest crypto adoption:

- Vietnam: Possession of cryptocurrency is currently prohibited in Vietnam. The State Bank of Vietnam declared that cryptocurrency is not a legal means of payment. Issuance and provision is prohibited, but a research group has been established to further understand crypto’s impact on the economy.

- India: As of March 25, 2022, a law was passed instating a 30% tax on those conducting cryptocurrency transactions and 1% deducted at source.

- Pakistan: Cryptocurrency is banned in Pakistan as government officials state cryptocurrency risks outweigh the benefits.

- Ukraine: Ukraine is a leading hub for crypto industries. Especially amidst invasion, many Ukrainians have turned to cryptocurrency rather than rely on a centralized institution. Currently, there are more cryptocurrency transactions per day than fiat currency. In March, President Volodymyr Zelenskyy legalized crypto in the country.

- Kenya: Kenya has shifted its attitude from total opposition to cautious optimism. Individuals dealing in cryptocurrency are subject to a capital gains tax.

- Nigeria: There is not an absolute ban, but all deals involving cryptocurrency are prohibited with severe regulatory sanctions. Banks must also identify persons or entities transacting or operating cryptocurrency exchanges and close their accounts immediately.

- Venezuela: The Venezuelan government collects 2-20% in taxes from large cryptocurrency transactions to incentivize use of fiat currency. The National Superintendence of Cryptocurrencies exercises powers to regulate creation, issuance, organization, operation and use of crypto assets. Bitcoin mining is legal in Venezuela and must join the National Mining Pool.

- United States: Cryptocurrency is regulated and taxes must be paid on capital gains made from cryptocurrency. It is legal to buy and sell cryptocurrency.

- Togo: Togo has an implicit ban on cryptocurrency. Banks and other financial institutions may be prohibited from offering crypto-related services or from dealing in them. Crypto exchanges are prohibited from operating in their jurisdiction.

- Argentina: Cryptocurrency exchanges are taxed 0.6% for purchases and sales of cryptocurrencies. The central bank is currently working on new regulations to improve KYC measures and prevent fraud.

Honorable Mentions:

- Russia: In recent months, Russia has changed its tune from banning crypto to embracing the alternative currency. The Russian government sees cryptocurrency as a strategic way to avoid sanctions instated by foreign governments after its attack on Ukraine. Regulations are forthcoming, likely in the second half of 2022.

- Canada: Cryptocurrency is regulated under securities law and characterized as a commodity for income tax purposes. In February the federal government proposed a bill to encourage the growth of the crypto asset sector in Canada.

Since its explosive entrance into mainstream culture, academics and policymakers have grappled with regulatory best practices for this new asset class. Cryptocurrency is legal in many jurisdictions worldwide, but the overall taxation and regulatory framework is inconsistent. Effective regulation will not only prevent illicit activities such as money laundering and terrorism funding, but provide tax revenue for governments. Furthermore, by supporting crypto assets, governments can foster a new technology sector centered around blockchain and its various applications. This year will likely be the year of crypto regulation as more countries recognize the need for leadership and guidance in navigating this burgeoning sector.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.