Crypto in the context of war

Cryptocurrency’s role in the Russia-Ukraine conflict could pave the way for future application in global conflict

As the Russian-Ukrainian war surges ahead, we are witnessing the value of blockchain and cryptocurrency in the age of modern warfare. The value of a new technology in society depends on how it is wielded. What blockchain offers to society is quite clear: decentralization, transparency and equal access. This is a critical point in blockchain and cryptocurrency’s evolution. The Ukrainian crisis is a real-time exploration of how crypto holders and lawmakers can use and observe this technology during times of political and economic uncertainty.

Blockchain for economic development and social change

Blockchain’s application far exceeds the facilitation of cryptocurrency. Its unique characteristics as a transparent, immutable and decentralized ledger make it a powerful tool in economic development and social change. In politically volatile nations, those seeking asylum lack basic identity documentation and property ownership documents. Scholars have considered the application of blockchain identity management in countries like Syria, where war created 5.6 million refugees. Verifiable universal identity or global passports can use blockchains to identify citizens. Blockchains are also useful as a tool for “banking the unbanked” - providing financial inclusion to approximately 2 billion of the world's citizens without access to a bank account. In rural India, citizens can use blockchains to connect to financial products and services with low transaction costs. In the case of civil unrest, crypto wallets can provide a safe haven for citizens to store their wealth when they cannot rely on centralized institutions.

Ukraine as a crypto hub

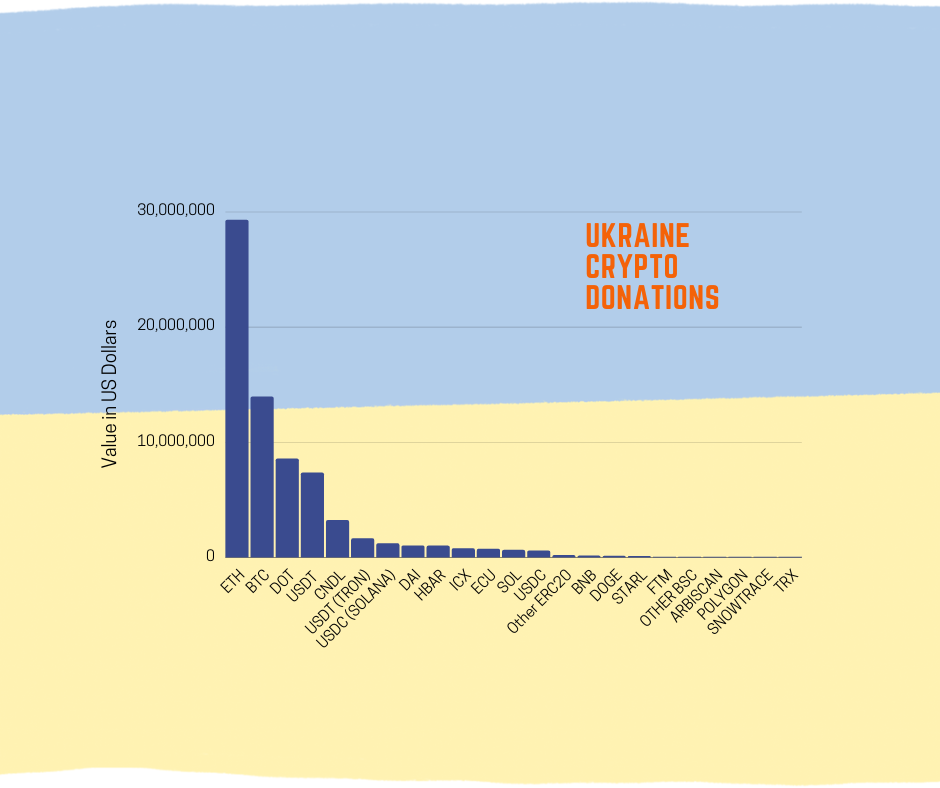

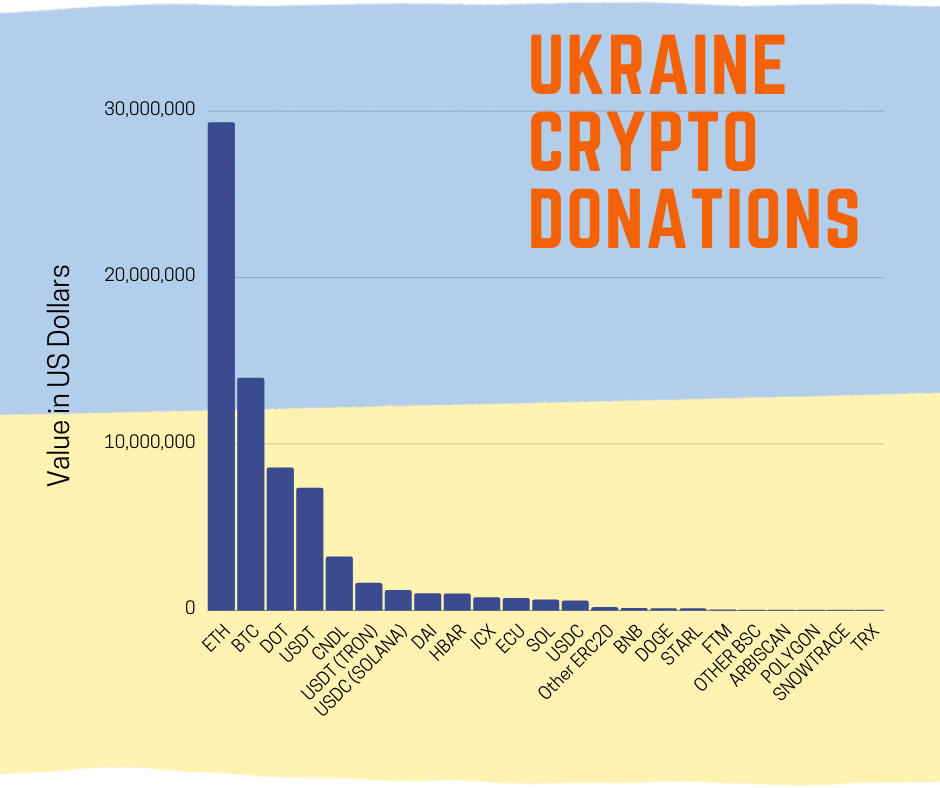

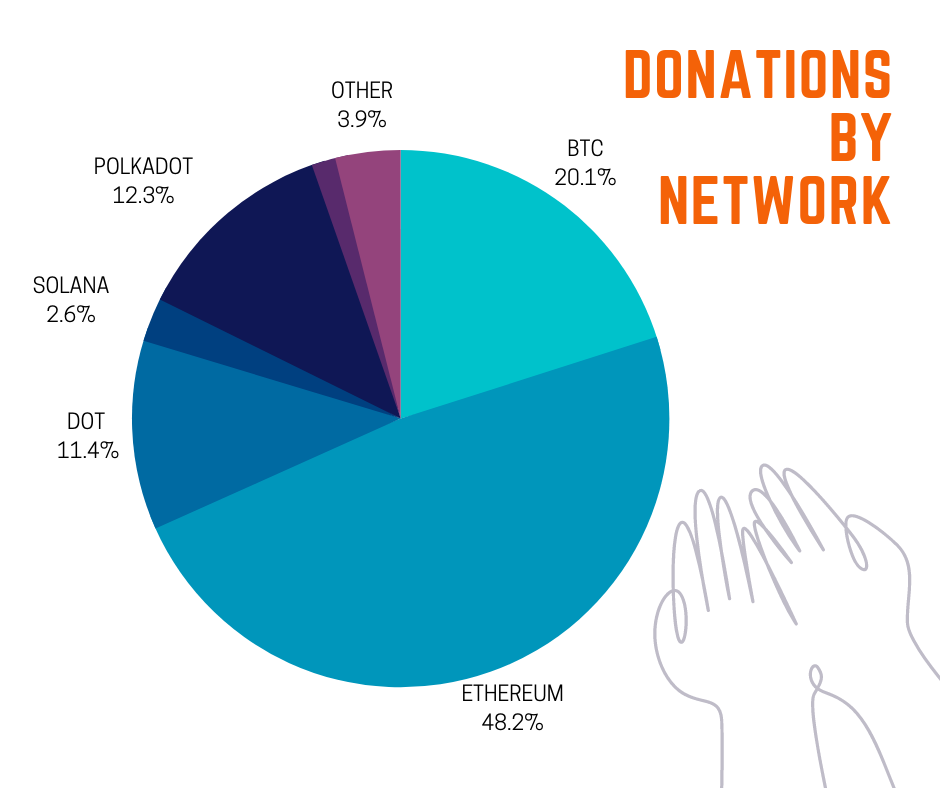

Prior to the Russian invasion, Ukraine had established itself as a crypto hub. A world leader in crypto innovation, Ukraine has embraced the technology and its potential for foreign investment and economic growth. Now, as citizens face civil destruction, senseless loss of life and forced displacement, the Ukrainian government is leveraging cryptocurrency to finance the war efforts. Ukraine announced a crypto donation campaign on the country’s Twitter page, posting wallet addresses. According to Michael Chobanian, some of the funds were used to purchase drones, goggles, gasoline, and bulletproof vests. Ukrainian citizens have used cryptocurrency as a key workaround in financing military supplies as mainstream donation platforms, like GoFundMe and Patreon prohibit military funding. Blockchains can also promote transparency and assure donors that their money is helping the war effort directly. So far, holders have donated over 60 million in cryptocurrency to Ukraine’s primary fund run by Kuna, a cryptocurrency exchange. The outpouring of support prompted Ukrainian President Volodymyr Zelenksyy to officially legalize cryptocurrency, creating a legal virtual asset market in the country.

[Right Image] Other denotes: TRON, BSC, DOGE, ICON, FTM, SNOWTRACE, ARBISCAN, POLYGON

Is Russia evading sanctions with crypto?

In contrast, many speculate that Russia’s application of cryptocurrency as a tool for evading sanctions. In reality, there are simply not enough funds on exchanges to meet the needs of such a large nation. Russia would have to convert billions of dollars worth of rubles into crypto, which they would be unable to source. Furthermore, it is exceedingly difficult to transfer the money Russia would need through crypto exchanges without drawing attention to itself. That is not to say that interested actors could not use cryptocurrency to evade sanctions. According to the Centre for New American Security, with the help of a former senior researcher and developer for the Ethereum Foundation, North Korea conducted cyberattacks against the United States and other jurisdictions to acquire funds to support its nuclear proliferation efforts. North Korea conducts cyberattacks like ransomware, phishing, online bank heists, among other tactics, to compensate for the money it loses due imposed sanctions

Russians who fear that the government will freeze their crypto assets are currently liquidating their crypto holdings into cash to store elsewhere. Moreover, as Russians seek financial safe havens, they have increased their interest in real estate in neutral jurisdictions, like Dubai. Ordinary citizens have also purchased crypto as the Russian ruble topples. For instance, Bitcoin and Tether trade volumes tied to Russian ruble pairs have risen.

USDT/RUB BTC/RUB by nplus1data on TradingView.com

For markets outside of Russia and Ukraine, bitcoin declined to $34,636.70 on February 24, the day Russian President Vladimir Putin ordered the invasion of Ukraine. It bounced back to $44,837.94 in the beginning of March and is currently sitting at $39,468.19 as of April 25.

Russia’s invasion of Ukraine has demonstrated to the world the unprecedented features of modern day warfare and the value blockchain presents when centralized institutions collapse. While the values of blockchain were built upon decentralized trust, equality and freedom, disruptive technologies ultimately reflect the values of the people who use them. In the case of warfare, ordinary citizens have used cryptocurrency as a way for ordinary people to store value and access funds in a time of civil emergency.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.