🚨 The Long Awaited Bitcoin ETF Approval has Finally Arrived

In this edition we explore the Bitcoin ETF approval, BCR-20s, Circle filing for an IPO and more.

🏆ETF Approval

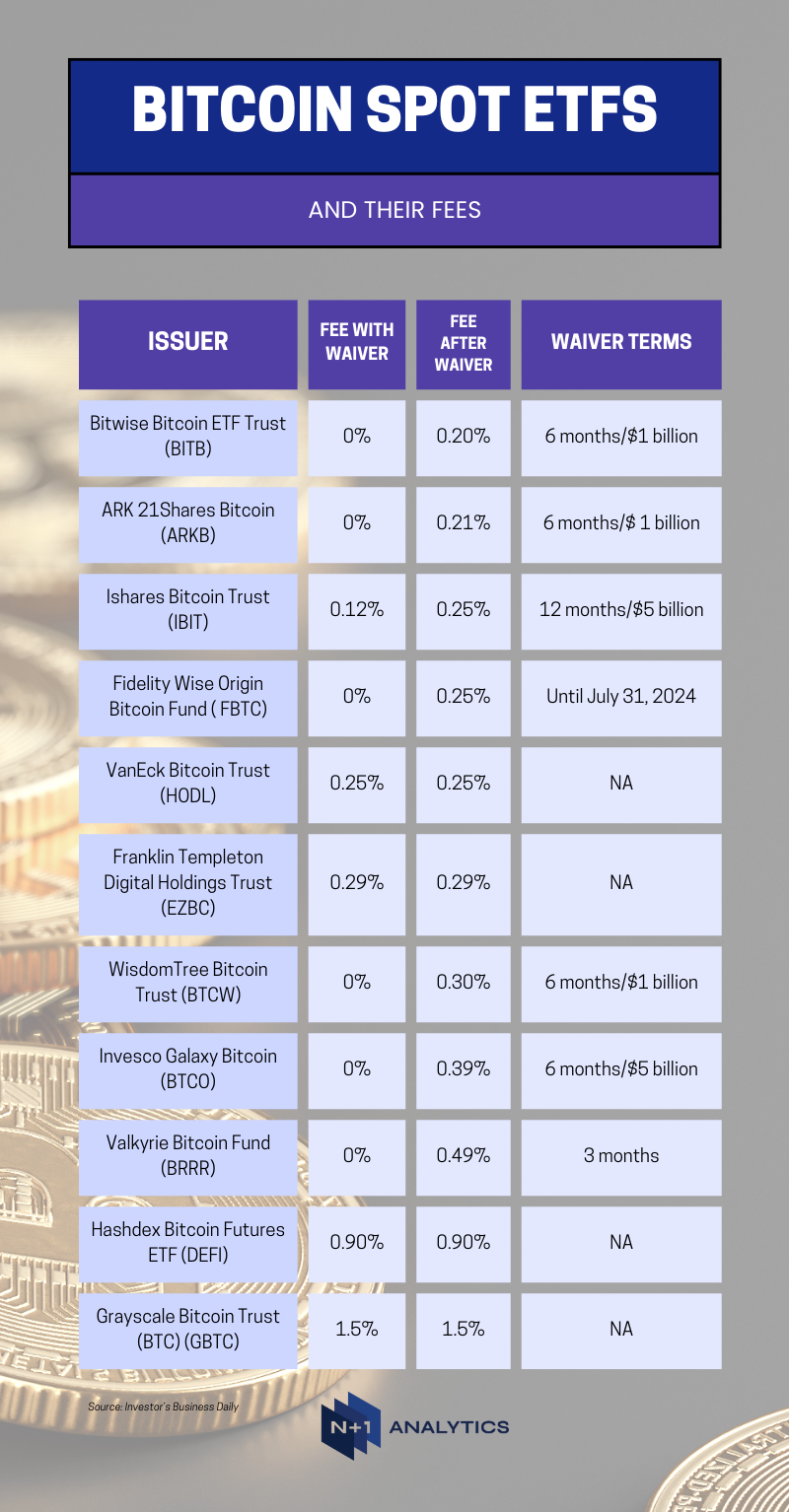

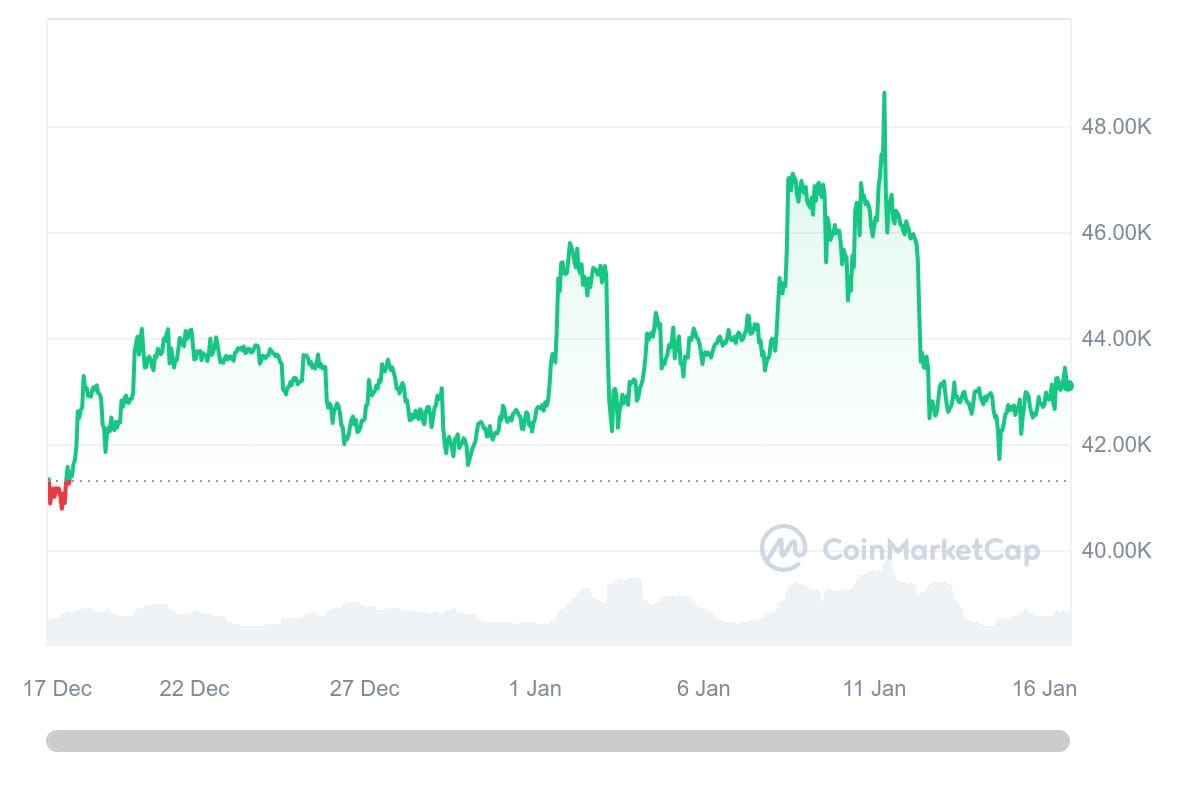

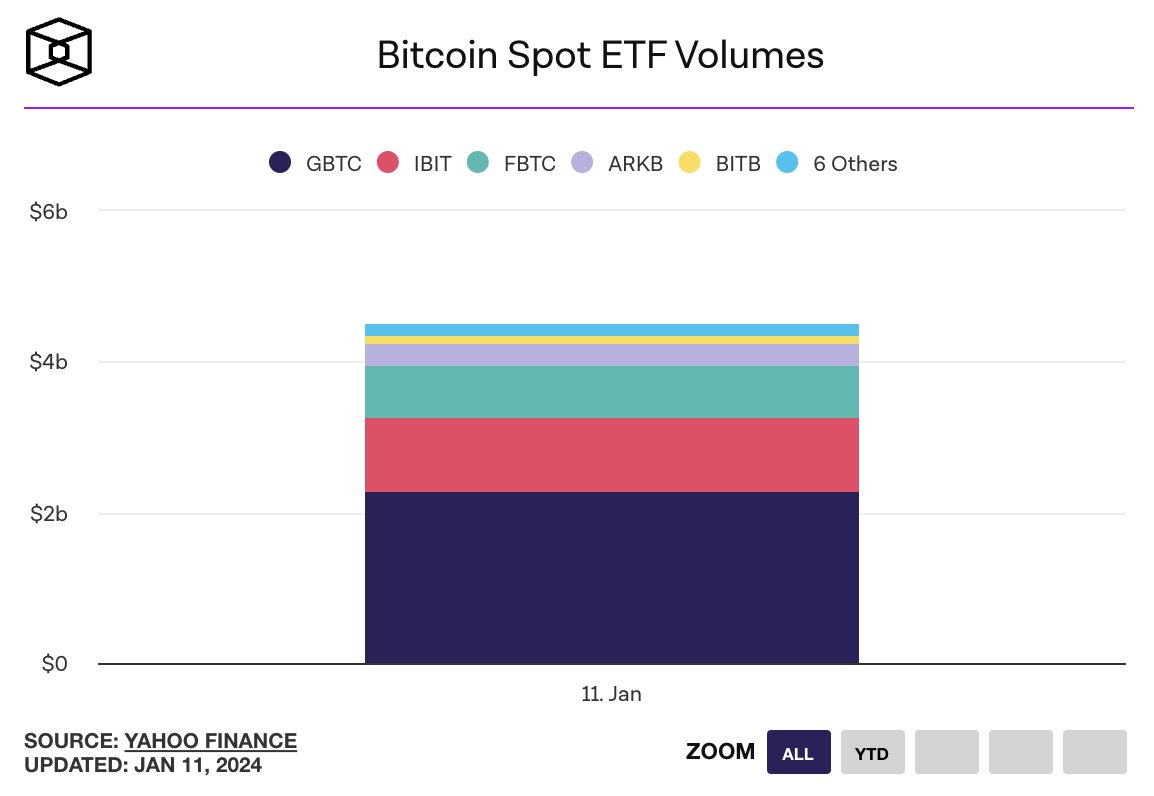

Last week, the long awaited Spot Bitcoin ETF was finally approved, with Gary Gensler acting as the deciding vote. Following the real announcement, Bitcoin briefly spiked to $49,000 before dropping below $42,000. The approval has also instigated discussions around an Ethereum ETF.

🪙 Altcoins with Shoal Research: BRC-20s

Definitions

Token standard: A set of rules that determine how a token works. It defines the functionality of a token, detailing its creation, transfer, mutation, and destruction processes.

Ordinals: Ordinals is the process of assigning a number to a satoshi, allowing it to be identified, and creating the ability to inscribe. A satoshi is the sub-unit of Bitcoin, like cents to a dollar.

ERC-20: Before BRC-20s, ERC-20s existed on the Ethereum blockchain. These are token standards for fungible tokens on the Ethereum blockchain.

What is it?

Bitcoin Request for Comment 20 (BRC-20) is a token standard created in March 2023 by a developer called Domo.

What does it do?

BRC-20 is a new implementation of the Ordinals protocol that enables minting and transferring of fungible tokens on the Bitcoin blockchain.

What does it mean?

BRC-20 tokens bring additional utility to the Bitcoin network. Coupled with the recent ETF approval, BRC-20s are a catalyst for growth due to the ongoing ETF narrative and Bitcoin projects that continue to roll out.

Why is it interesting?

To date, Bitcoin’s use cases are transactions (although slow and limited) and a tradeable store of value. However, there has been an shift from Bitcoin as a store of value, to Bitcoin as a utility. With new utility, comes new value accrual for Bitcoin and the possibility for the replication of common ecosystem projects like DeFi and NFTs.

Check out Shoal Research’s Substack and Telegram channel.

💻SEC hacker

Bitcoin prices jumped on Tuesday after the SEC’s account released a message announcing the approval of a Bitcoin ETF. Shortly after the announcement, Gary Gensler reported that the SEC’s account had been compromised. Bitcoin prices rose by 2.5% before falling again as a result. According to reports by X, the SEC did not have 2FA set up. The FBI is now investigating.

💰Circle Files for IPO

The USDC issuer, Circle, filed for an initial public offering (IPO) with the SEC on Thursday. An IPO turns private company shares into publicly traded shares on a stock market. Circle attempted to go public in 2021 through a special purpose acquisition company, but the deal was not completed after the transaction timed out. USDC is the second largest U.S. stablecoin with a market cap of $25.2 billion.

🪄Taproot Wizards Selling NFTs

Taproot Wizards are launching a new NFT collection. Originally an Ordinal developer, Taproot Wizards produces “magic internet JPEGS”. However, their latest project is a collection of NFTs called Quantum Cats. The name of the project refers to a string of code found in the original release of Bitcoin called “OP_CAT”. The code was removed by Satoshi in 2010 but there are calls to bring it back. Advocates say that the code could make Bitcoin resistant to attacks by quantum computers. Taproot Wizard’s Quantum Cats therefore references this movement.

📚 N+1 Recommendations

The N+1 reading and media recommendations are sourced from our team of experts and offer weekly suggestions for learning more about blockchain, crypto, finance and technology.

This weeks recommendation: Bitcoin Billionaire by Ben Mezrich

📊Charts of the Week

🤩 This Week on Crypto Twitter

JUST IN: BlackRock CEO Larry Fink says they "see value in having an Ethereum ETF."

— Watcher.Guru (@WatcherGuru) January 12, 2024

A few of us when we're with our normie friends and family this weekend: pic.twitter.com/A4GDAynXYP

— James Seyffart (@JSeyff) January 12, 2024

Welcome to the volatility of #Bitcoin, ETF holders 👀 pic.twitter.com/l1WZbR0vil

— Bitcoin News (@BitcoinNewsCom) January 12, 2024

🚨 Follow us!

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.