As regulators come for crypto, Ripple faces off with the SEC

A look into the lawsuit that could dramatically affect crypto regulation in the U.S.

The ongoing Ripple vs. U.S. Securities and Exchange Commision case could impact cryptocurrency prices, future regulatory decisions and sentiments about crypto operations remaining in the U.S. As the two-year trial nears its end, here are important things you need to know.

What is Ripple?

Ripple was featured on Forbes Fintech 50 and Blockchain 50 lists in 2019 and 2020. Founded in 2012 by Chris Larsen and Jed McCaleb, Ripple is a settlement system, currency exchange and remittance network aimed at banks and financial institutions. Ripple focuses on creating value networks with real-time, cross-border transfers through blockchain technology. In essence, they offer a fast, cost effective money transfer method to rival technologies like SWIFT networks.

What is XRP?

XRP is the native token used by Ripple. It offers exchange mechanisms to connect two currencies or networks. Unlike most cryptocurrencies, XRP is premined, with a maximum supply of 100 billion tokens.

XRP runs on a consensus mechanism which consists of a unique node list of trusted validators who approve transactions. Ripple can throughput 1,500 transactions per second, at a cost of $0.0002 per transaction, resulting in a scalable, affordable technology. The token is touted as green and is reportedly 61,000 times more energy-efficient than proof-of-work blockchains.

What is the SEC?

The U.S. Securities and Exchange Commission (SEC) is an independent agency focused on protecting investors, facilitating capital formation and maintaining fair, orderly, and efficient markets. The SEC regulates securities, which include stocks, bonds, mutual funds and ETFs.

Lawsuit basics

In 2020, the SEC alleged that Ripple sold over 14.6 billion units ($1.38 billion USD) of an unregistered security. In response, Ripple argued that XRP is not a security. More recently, the CTO of Ripple took to Twitter, arguing that XRP should be considered a commodity. Ultimately, the key factor of this lawsuit is determining if cryptocurrencies are securities.

Commodity vs. security

If categorised as a security, XRP would fall under the control of the SEC. This determination would result in more strict regulation for XRP, including the requirement to register for a licence in order to sell the securities. This would ultimately prevent XRP from being traded on U.S. based exchanges without registering as a security.

If XRP is considered a commodity, as the Ripple’s CTO claims, the Commodity Futures Trading Commision (CFTC) would regulate XRP. This distinction also matters for crypto exchanges in the U.S. As a commodity, XRP could list on any exchange without any additional scrutiny.

There is a general sense that CFTC regulation is less strict than securities. While the CFTC has pushed back against this belief, the CFTC is generally the preferred regulator in the crypto community. The SEC and CFTC seemingly do not agree on who will have regulatory power over the crypto space, as both regulatory bodies have filed suits claiming that cryptocurrencies are securities or commodities respectively.

How is a security determined?

The SEC uses The Howey Test to discern what is and isn’t a security. The Howey Test is described as a four-pronged approach which states that a security is an investment of money, in a common enterprise, with a reasonable expectation of profits derived from the efforts of others.

The Chief Legal Officer of Ripple, Stuart Alderot, claims that the SEC is failing to identify an investment contract and is struggling to prove the four prongs. Another lawyer in the space, Jeremy Hogan, further supports this sentiment.

Impacts of the court ruling

From the CFTC suing Binance to Paxos and Coinbase receiving Wells notices, the SEC v. Ripple case comes amidst a push for crypto regulation and legal action following the FTX fallout. Most recently, the SEC announced its move to charge Bittrex for operating an unregistered national securities exchange, broker and clearing agency.

The SEC v. Ripple case represents the potential regulation of a significant player in the space and therefore could have impacts on crypto companies and markets as a whole. The court’s ruling on SEC v. Ripple could determine the level of restrictions placed on other cryptocurrencies, impact prices and, more broadly, impact the sentiments about crypto in the U.S.

If Ripple loses, this could set a precedent for regulating cryptocurrencies as securities, potentially indicating further regulatory and legal enforcement to come. However, if Ripple wins, it could help to strengthen XRP’s mission, and cool the SEC’s efforts to regulate crypto in the U.S. market. The decision could additionally impact Ripple prices, which have already gone up 20% as the case moved closer to a verdict.

Crypto in the US

In an interview, Ripple CEO Brad Garlinghouse stated that Ripple can move offshore and continue to build and grow. Garlinghouse went on to critique U.S. regulations, arguing that they lacked clarity. This mirrors a complaint from Coinbase, which states that they cooperated with the SEC and even sought direction from them, only to be given the Wells notice.

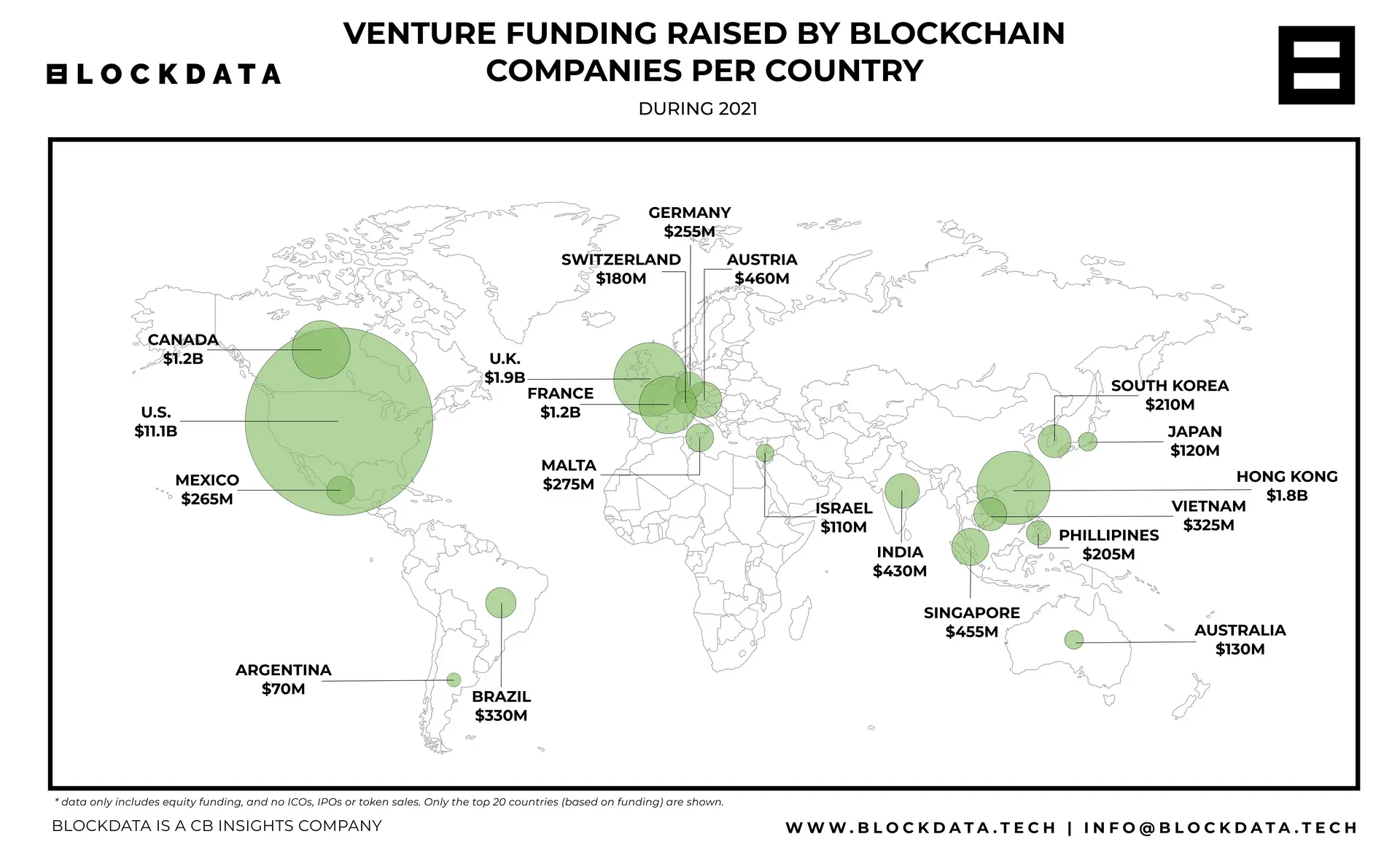

As a result, there is a general sentiment that the U.S. is becoming less crypto friendly. This feeling has been further amplified by a wider financial crackdown sometimes referred to as Operation Choke Point 2.0. Reportedly Europe, Japan and Singapore offer more clarity around regulations and are generally friendlier, with some crypto players already leaving the U.S. The decision on SEC v. Ripple is expected sometime in 2023.

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.