🧸 Are Beanie Babies Securities?

In this edition we explore the dYdX market, the Coinbase lawsuit, the Ethereum Dencun upgrade and more.

🪙 Altcoins with Shoal Research: MEV

What is it? MEV or Miner/Maximal Extractable Value is the extra profit miners or validators can gain by manipulating the transaction order in blocks. Manipulation can include strategies like front-running or sandwich attacks. Users often experience MEV when swapping trades on DEXs like Uniswap. Meanwhile, there is little MEV on some blockchains because the margin of profit is extremely slim.

What does it do? MEV highlights the additional value that validators and searchers can extract from their role beyond standard block rewards and transaction fees. MEVs bring up issues of blockchain fairness and economics.

What is the impact? Some people consider MEV to be a negative consequence to the architecture of a smart contract blockchain. Others think MEV is crucial for decentralized systems since arbitrage is often used to keep prices balanced.

Why is it interesting? MEV offers insight into blockchain technology's economic and game-theoretical aspects, driving innovations in smart contract and DeFi designs. MEV exists differently on different chains and, in most cases, negatively affects users.

Definitions

Front-running - Trading based on advanced knowledge of future transactions.

Sandwich Attack - Placing orders around a target transaction for profit.

Block Rewards - Rewards for adding a block to the blockchain.

Transaction Fees - Fees paid for transaction inclusion in a block.

DEXs - Platforms for direct cryptocurrency trading without intermediaries

Check out Shoal Research’s Substack and Telegram channel.

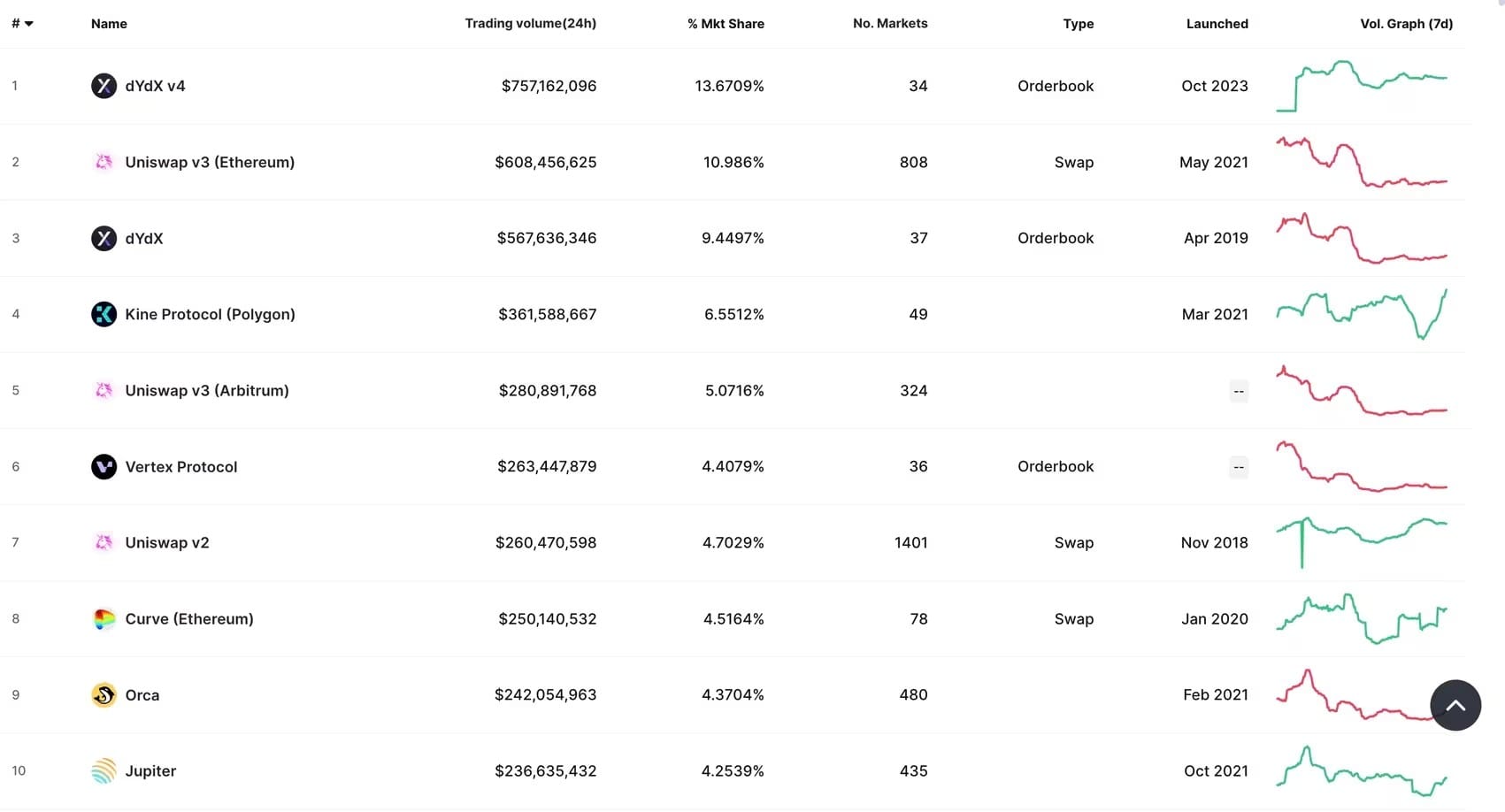

👀 DYdX Market hits $747 Million

On January 18th, the dYdX v4 market surpassed $757 million in 24-hour trading volume, overtaking Uniswap’s v3 Ethereum market. DYdX’s v3 market took third place on the list. DYdX allows perpetual contracts – contracts that mimic the features of traditional futures but without an expiration date. The decentralized exchange had recently migrated from Ethereum to Cosmos.

🧸 Are Beanie Babies Securities?

On January 17th, the Coinbase and SEC trial continued as Coinbase attempted to have the case dismissed. The judge, Katherine Polk Failla, came prepared with 14 pages of questions. Failla expressed concern that the SEC’s definition of securities is too broad and the SEC argued that under the SEC’s definition, most things become securities. This problem was expressed in the trial itself, through the example of Beanie Babies - should they be deemed securities?

⛓️ Ethereum Dencun Upgrade

Last Wednesday, Ethereum’s latest major fork, Ethereum Dencun, launched on the testnet. This upgrade is set to improve the network’s scalability, efficiency, data availability and, eventually, transaction cost across the network. At launch time, the upgrade was hit with a four-hour delay due to a bug in Prysm, Ethereum’s proof-of-stake client. The upgrade is expected to be on the mainnet in the first quarter of 2024.

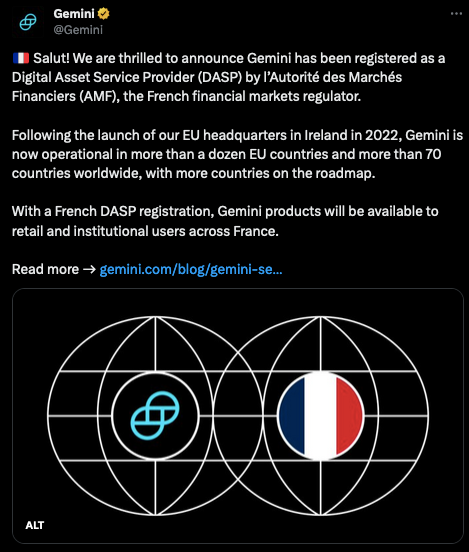

🇫🇷 Gemini in France

Cryptocurrency exchange Gemini has been granted registration in France by the Autorité des Marchés Financiers. The approval means Gemini can operate in France as a digital asset service provider (DASP). In the announcement, Gemini said that there will be over 70 cryptocurrencies available over the coming weeks. This follows Coinbase and Circle, who registered in December 2023.

📚 N+1 Recommendations

The N+1 reading and media recommendations are sourced from our team of experts and offer weekly suggestions for learning more about blockchain, crypto, finance and technology.

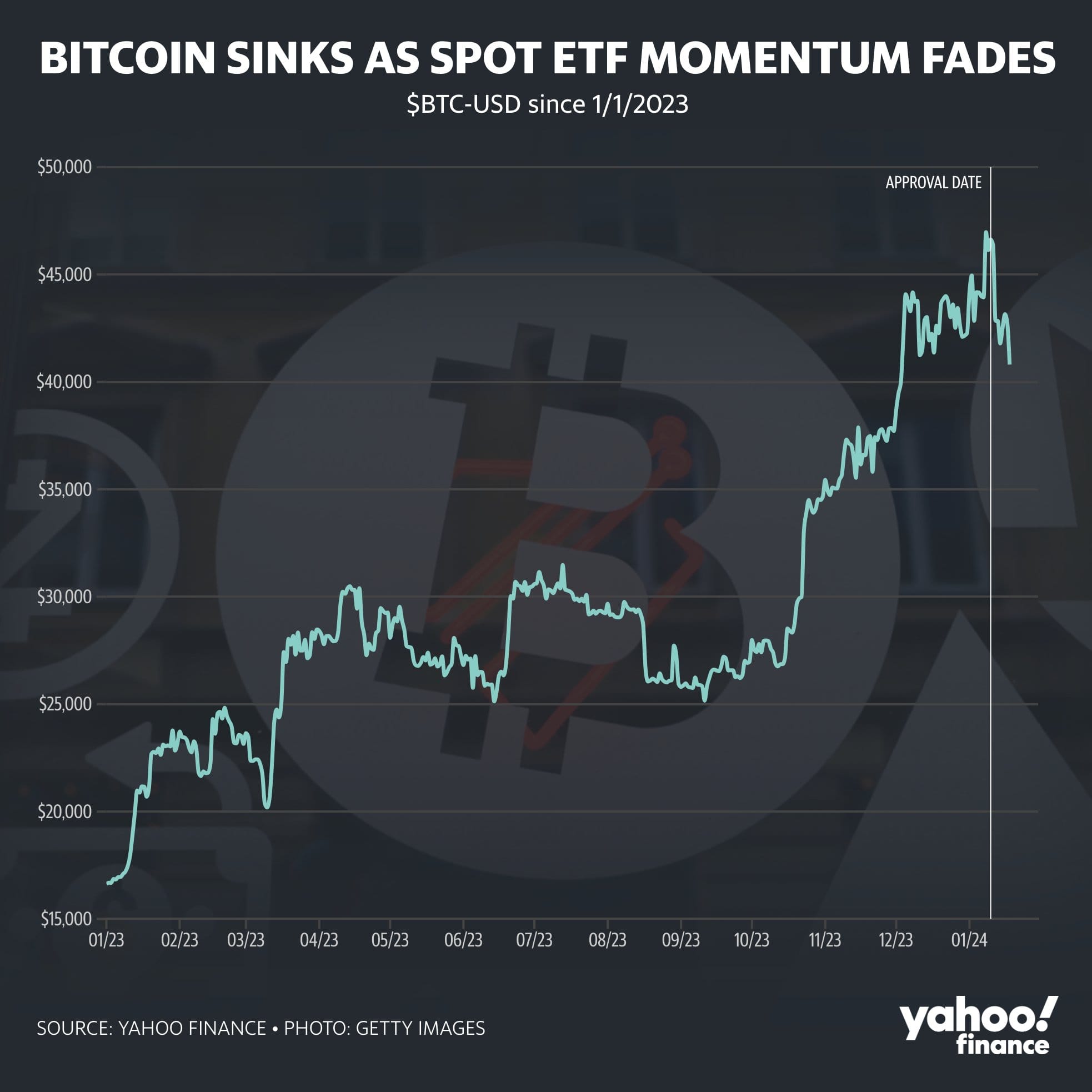

This weeks recommendation: The Chopping Block: When Will the ETF Hype End?

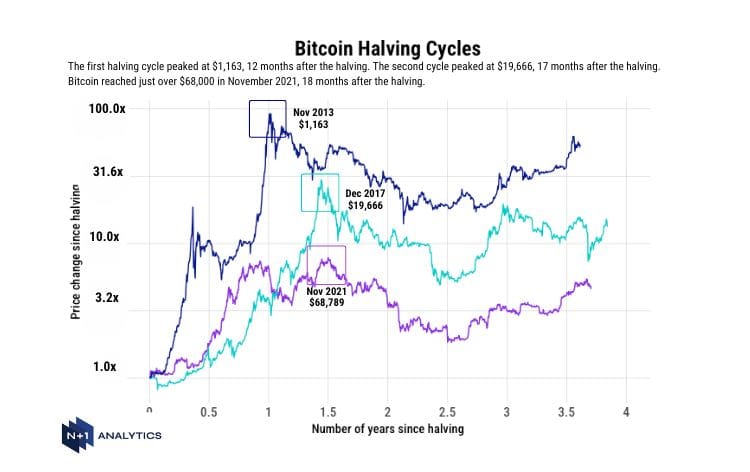

📊Charts of the Week

🤩 This Week on Crypto Twitter

Day 5 #Bitcoin ETF Cointucky derby update. Waiting on data from $IBIT/BlackRock and $BRRR/Valkyrie. But $GBTC with another Big outflow -- $582 million. Total out of GBTC is $2.2 billion so far. pic.twitter.com/XxXfyJCA60

— James Seyffart (@JSeyff) January 19, 2024

Why are people so angry about spot bitcoin ETFs…

— Nate Geraci (@NateGeraci) January 19, 2024

Such an odd phenomenon.

You like getting btc exposure via ETF? Great. Invest.

Want to own btc direct? Go for it.

Mad that spot btc ETFs didn’t make “price go up”? Welcome to financial markets.

ETFs simply a delivery vehicle.

— Chris Burniske (@cburniske) January 18, 2024

🚨 Follow us

N+1 Insights is meant for informational purposes. It is not meant to serve as investment advice.